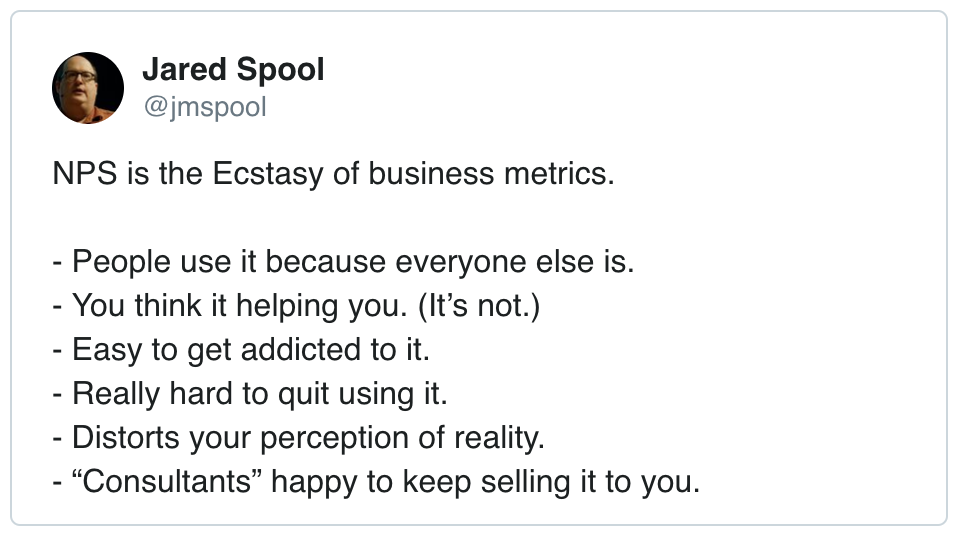

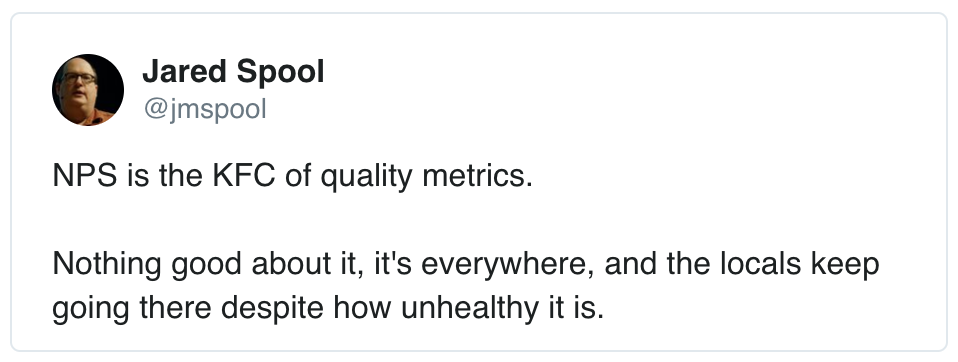

Net Promoter Score, The Ecstasy of Business Metrics?

Net Promoter Score® (NPS) has come under scrutiny. Everything from the way it’s calculated, the 11-point scale used in the survey, and its lack of correlation to company growth.

“It turns out, it’s neither simple nor profound. It doesn’t help businesses grow. It doesn’t even tell the management how loyal the customer is.”

That’s how Jared Spool described NPS in his piece, Net Promoter Score Considered Harmful.

And here are a few of his tweets about NPS:

Ouch.

He’s not the only one who doesn’t like NPS scores. After I shared that 55% of people measure customer happiness using NPS, I got a few emails railing against NPS surveys:

“In my opinion NPS is one of the most over-relied upon tools going around. It’s useful as a VERY rough trend line on how you are travelling and also a really good lead gen tool for uncovering further insights by reaching out to people to learn more about their comments. So often I see people try and do weird and wonderful things like attribute it as a success metric against product development – crazy town.”

“I see companies asking too much how I’d score them. They often use these surveys for covering up their own shortcomings, for stats, for their boss, for ISO 9001.”

When NPS first came on the scene, it was touted as “The One Number You Need to Grow”. That was 15 years ago. Times have changed and there’s a lot more to understanding your customers than one single number can ever tell you.

I’ve been using NPS in my own businesses and helping others implement it in theirs since 2005. And it’s never proven to be harmful. In fact, quite the opposite. When used as one of the many ways a company gathers and acts on feedback, NPS is quite powerful.

How to Actually Use NPS to Make Your Product Better

In isolation, any method of getting feedback loses usefulness. For example, if you only focus on user tests, you’ll miss out on key insights you’d get from interviewing your customers. If you simply rely on product-market fit surveys to assess your product, you’ll end up making critical decisions in the absence of any quantitative data.

NPS is no different.

Just like any form of customer feedback, the feedback you get from NPS scores only matters if you use it to make your product better. Which means you need to know how to use it to make your product better, right?

When companies use NPS effectively to drive product improvements and growth, I’ve seen them take three key steps along with sending an NPS survey.

1. Take Action on Each Score

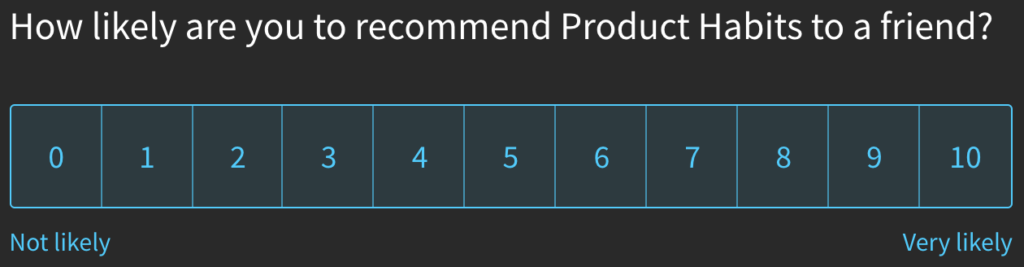

NPS has a built-in segmentation as part of the framework: Promoter, Passive and Detractor.

Promoters are people who respond to the NPS survey question with a 9 or a 10. They tend to be people who would personally vouch for the product and recommend it to other people.

Since they are so excited about your product that they are willing to share it with a friend, Promoters can be asked to do things like leave reviews or participate in case studies. They can also be asked to participate in customer interviews, which can be used to dig deeper into their sentiments about your product. Some NPS tools have this built in as a feature so you can easily solicit your customers to leave a review or participate in a case study right after they complete the NPS survey.

Make sure you’re following up with your promoters and making the most of their goodwill.

Passives are people who gave a 7 or 8. It is likely that they will not put their name on the line to vouch for the product.

With passives, the key is to analyze their open-ended responses in order to understand what’s causing them not to be promoters. It could be that they aren’t the right type of customer for your product or that they haven’t experienced the same “AHA” moment that promoters have. Once you are armed with this type of information, you can make changes to your product and even your marketing to get more promoters.

Prioritize the feedback from the passives into your roadmap.

Detractor responses with a 0, 1, 2, 3, 4, 5, or 6 will often actively convince people not to use the product.

Detractors are people who weren’t satisfied with your product at the time they took the survey, and can offer vital information about what’s missing in your product.

Following up with detractors over email and interviews (if they are willing) can provide a goldmine of information. For example, if your product integrates with other products and you keep hearing from detractors that core integrations are missing, that’s a strong indicator of improvements that could help increase customer happiness.

Look for product improvements that could open up whole new markets from the detractors.

Additionally, following up helps build goodwill for your brand. When customers feel heard, their sentiment about your business can change. They might even change their tune and become more likely to be promoters in the future. You’ll also get an opportunity to directly address any concerns they have. This sounds small but it will impact your brand and word-of-mouth over time.

2. Further Segment NPS Scores

There’s not much you can do with NPS scores if you boil your entire customer base down to a single metric. It’s an elegant and simple solution, but the number in itself is not actionable alone. It’s the insights that you get from the segmentation and open-ended responses that get you the real value.

Segmenting users and understanding their responses based on each specific segment can unlock a huge amount of value.

To do this, first pick a segment to analyze. Next, calculate the NPS score for that segment. Third, review and analyze that segment’s open ended responses from the second question – “What is the main reason for your score?”

What kinds of segments are worth analyzing? Here are just a few:

- Pricing plans. Is the user free? On the basic plan? The plus plan?

- Company size. How big is the company? Enterprise? Hundreds of people? Or just a few?

- User age. What are the scores of the most recent set of new users? How are they in comparison to users who have been using the product for years?

- Customer journey. What are the scores at each part of the customer journey?

To do this type of segmentation you’ll need the ability to tie the segmentation information about each person to their score and open-ended survey response. This is typically done by passing NPS data into your analytics tool or passing the segmentation data into your NPS tool. It can be tedious to figure out, but is well worth it in order to get critical insights about different segments of your customers.

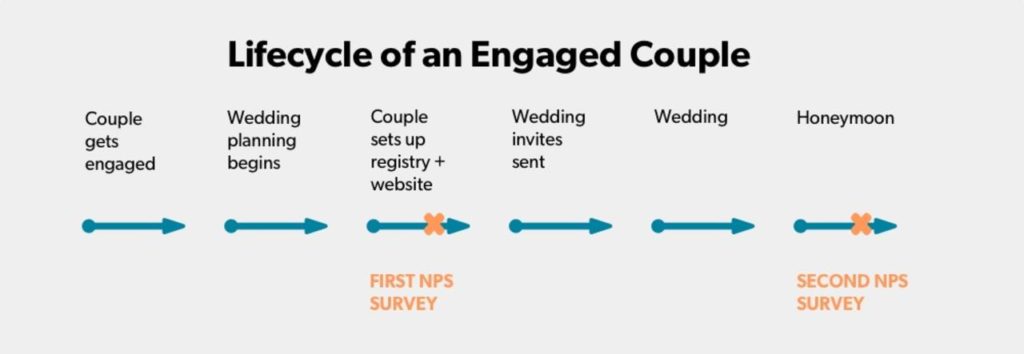

Wedding registry company Zola segments NPS by measuring NPS in two parts of its customer journey. First, when a couple sets up their registry. And second, after their honeymoon.

This segmentation gives Zola an understanding of issues that can happen at different parts of the customer lifecycle. Plus, it lets them understand how customers feel after key moments in their journey.

Understanding the NPS scores at different points in the customer journey gives you a more complete picture of how customer sentiment changes (or doesn’t) as people continue using your product over time. This way, you can isolate each part of the lifecycle and make decisions about what to improve and why, specific to each part.

3. Use NPS Scores to Align with your Team and Company

Meetings that simply review NPS scores with a long list of other items aren’t valuable. NPS shouldn’t be used as a vanity metric and should never be artificially inflated to make executives happy or to meet bonuses.

If you’re simply collecting NPS to report on the score on a monthly or quarterly basis you won’t get much value from it.

Instead, NPS should be used to help your team get on the same page about the problems that exist with the product. In companies that are using NPS successfully, it facilitates communication about the customer between different teams.

During monthly meetings, these conversations typically happen between product managers and customer success people and in many cases, wouldn’t happen if not for NPS surveys. The product managers and customer success team meet and discuss what customers are saying. This includes the sharing of information coming in from customer support requests, customer interviews as well as NPS surveys.

After these meetings, follow up with these customers with in-depth interviews to understand why customers feel the way they do. This happens because NPS kicks off a set of customer interactions that lead to priceless learnings which can then be used to improve the product.

Sharing NPS scores with the entire company after follow-ups with customers is helpful to spark conversations about product direction and challenges that customers are experiencing. The whole team gets to hear not only the score and open-ended survey feedback, but also what was learned after the fact in analysis.

NPS spurs the recognition that there’s a problem across the company and the rest of the process keeps everyone aligned during the research and product development. You’ll cover ground a lot faster than personally trying to convince everyone on your team that your product has gaps.

This way of using NPS informs your product roadmap, just like any other source of customer feedback. And better yet, the next time you get NPS results you’ll be able to tell if you made a difference or not.

NPS can be super valuable if used properly. Used in isolation and not acted upon, it can lose its importance and the benefits of the feedback from it get lost easily.

Ultimately, any type of customer feedback you get only matters if it helps make the product better.