What Will Amazon Build Next?

There’s only one company crazy enough to take on a centuries-old product that is beloved by people of all ages and backgrounds across the globe: Amazon.

There’s also only one company that could actually pull it off: Amazon.

The Amazon company consistently pulls off hit products that overtake the market, even when the odds are stacked against them. For example, for years, consumer device companies like Sony and SoftBook struggled to get bibliophiles on board with e-readers. Then Amazon stepped into the market and successfully sold a $399 digital reading device.

Then, in a world dominated by rectangular touchscreens, Amazon introduced a cylindrical, voice-activated smart device with no immediately clear use-case. Now Alexa is a household name and loved by people around the world.

Amazon’s projects are always on the cutting-edge of the current consumer technology landscape. They push boundaries and the market usually goes along with it in a big way. The company reported net revenue of $177.87 billion in 2017. And though the majority of their revenue still comes from online retail product sales, products like the Kindle and Echo have turned Amazon into a tech superpower and have paved the way for Amazon to shape the future of consumer tech interactions.

Part of their ability to build grand slam products is their famous customer-centric mindset. But it’s more than that. The key to Amazon’s success lies in their ability to deliver products that are somewhere in between what customers say they want and what they don’t know to ask for yet.

Finding this sweet spot means a lot of research, iterations, and the occasional total failure. But as long as Amazon is trying and testing ideas, they’re learning more about what users want and how to anticipate what comes next. This is the mission-critical information.

There’s so much to say about how Amazon became an e-commerce behemoth and tech leader. But the process that Amazon uses to build and market consumer tech products is more important for other startups to understand. With the Kindle and the Echo—both of which are pretty different products—Amazon was able to take over entirely new product categories and win the hearts of the market. To take a closer look at how exactly they did this, let’s break down:

- How Amazon digitized the “last bastion of analogue” so successfully that the Kindle became more popular than they could have imagined

- How Amazon shifted focus in recent years to yet another huge frontier: digitizing the home with the Echo and Alexa technology

Let’s dive into the hype behind Amazon and understand how they unveil product after product that early critics sometimes hate and tens of millions of users end up loving.

2004-2014: Amazon digitizes the “last bastion of analogue”—the book

“The book just turns out to be an incredible device.” – Jeff Bezos

The book has never needed an update. Amazon didn’t need to build an e-reader to become a successful company. But the Kindle has been one of the big keys to the company’s growth over the past decade because it proved that Amazon could build great consumer products.

Selling books was a great way for Amazon to get a start in e-commerce. In 1994, Bezos created Amazon on the belief that the internet was a great place to sell books. He saw a huge, viable market: books are standardized all over the world, and there’s no need to see a book in person before you buy it. Amazon staked their claim on the internet, and they quickly became the leading online retailer of books.

Then in 1998, Amazon made a move that changed the course of e-commerce forever: they purchased an online shopping service called Junglee Corporation that helped people shop online for clothes, home items, electronics, and various products. Amazon began selling more than just books—they started selling everything.

By 2004, the online book provider had become a huge e-commerce platform and was doing close to $7 billion in yearly revenue. Amazon was also on their way to becoming the backbone of the internet: in 2006 they released AWS and made it easier, faster, and cheaper across the board for developers to build websites. The company grew quickly: in 2007 they had doubled ARR in three years to over $14 billion.

When Amazon began developing a digitized book from 2004-2007, they weren’t trying to find their niche. The company was already 10 years old and successful by many different standards. But at this moment, the leading e-commerce platform and essential development tool provider decided their next big move was to create an e-reader.

To outsiders, it may have seemed like a strange move for an e-commerce company—and an even stranger decision because the e-reader market didn’t look promising. Analogue books already did everything readers wanted, and tech history is littered with failed attempts to change their minds.

Rocket eBook by NuvoMedia. [Source]

Reader by SoftBook. [Source]

The Cybook by Cytale and, later, Bookeen. [Source]

“Music and video have been digital for a long time, and short-form reading has been digitized, beginning with the early Web. But long-form reading really hasn’t.” – Jeff Bezos, 2007

Amazon already had a lock on the online book market—digital books were a natural expansion. Amazon had potential to win over an unconquered market, if they could get it right.

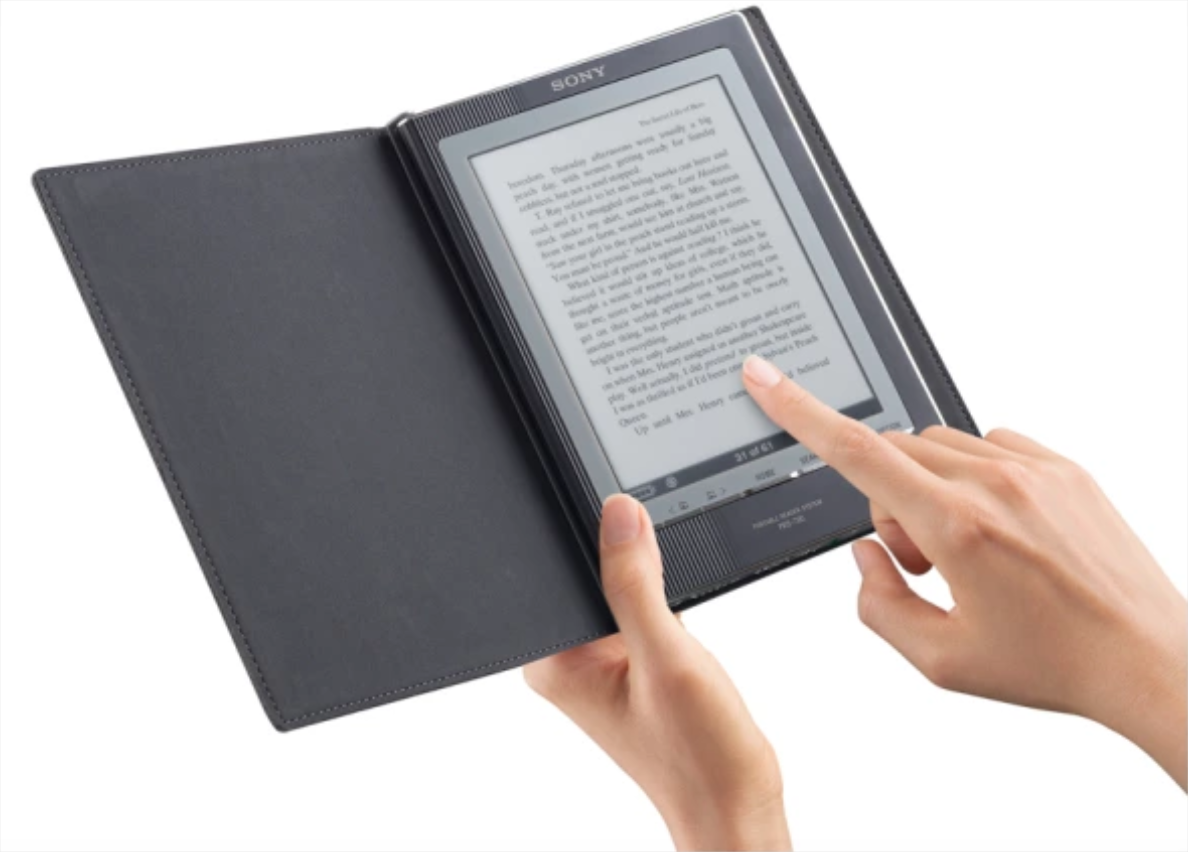

And by 2006, other companies were getting close. Sony launched their e-reader that year, which was a huge improvement on previous digital reading devices because it was slimmer, lighter, and had a new “digital ink” that read more like paper than a computer screen. People actually liked it.

[Source]

This was where Amazon could step in and step up. Amazon already had strong relationships with big publishers. They had a deep understanding of what publishers wanted. From here, Amazon was able to reconfigure distribution and profits for ebooks to turn them into attractive options for publishers.

“If you’re going to do something like this, you have to be as good as the book in a lot of respects. But we also have to look for things that ordinary books can’t do.” – Jeff Bezos

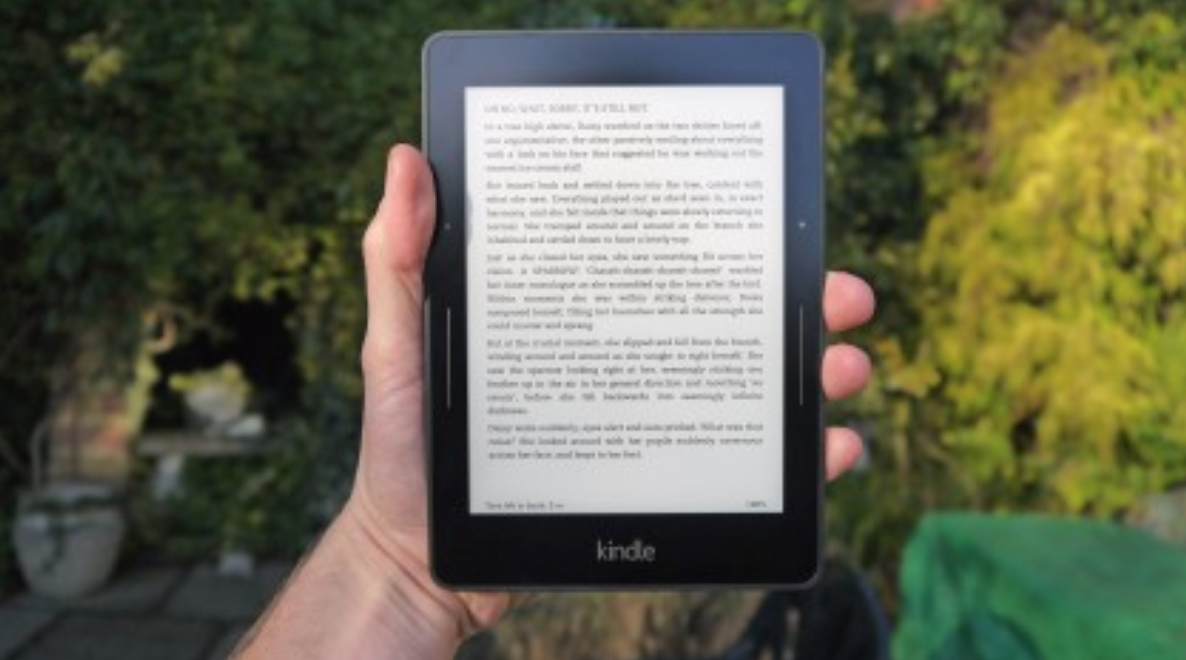

With the cooperation of publishers, Amazon could provide more digital books to readers on one device than anyone ever had. This was how Amazon was able to make sure that the Kindle was really an update to the book. The product gave readers an entire library literally in the palms of their hands.

Once they had the concept, they continuously iterated on the device to deliver a product that would resonate with their market. Here’s what this process looked like:

2004: Jeff Bezos and Steven Kessel, Senior VP of Worldwide Digital Media, started talking about making an e-reader. Jeff Bezos was personally interested in the idea, and it seemed like a natural extension of Amazon’s existing book e-commerce business. They hired a systems engineer named Jateen Parekh and a former hardware engineering VP at Palm Computing, Gregg Zehr. Parekh and Zehr started Lab126, a research lab under Amazon’s ownership that would incubate several new projects. As they began to do research, the team realized that the e-reader market had no clear winner and saw an opportunity. They started working on an early version of the Kindle based on Bezos’s vision. His number one request, on top of his many product visions and feature requirements, was, “Make it drop dead simple to use.”

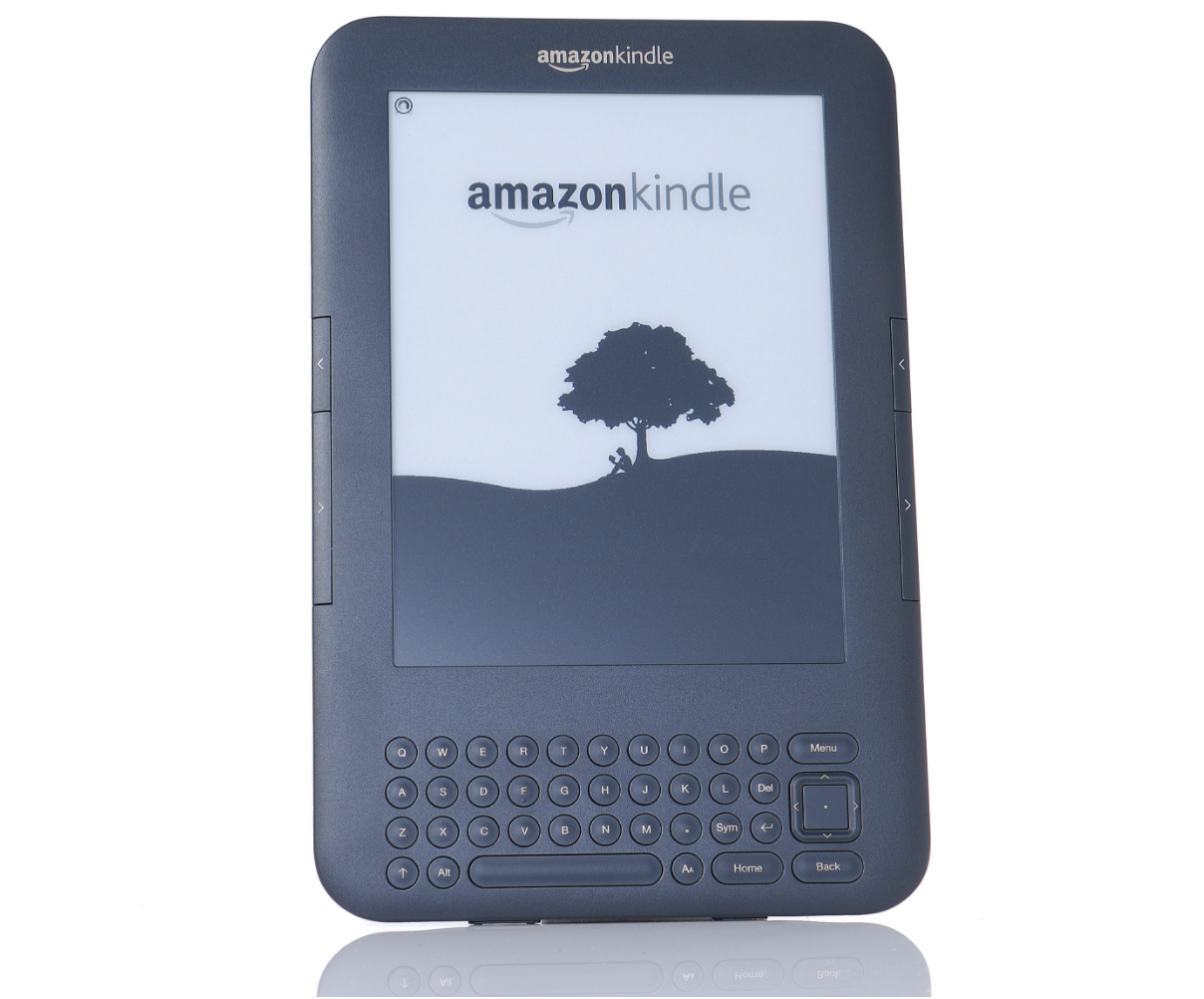

2007: Development took three years, and many things went wrong in the process. The pre-existing technology was complicated and there were legal issues around getting some of the parts. The biggest challenge: enabling the device to connect with the internet from anywhere, without needing WiFi. After a long development process, Amazon finally released the Kindle in the fall.

[Source]

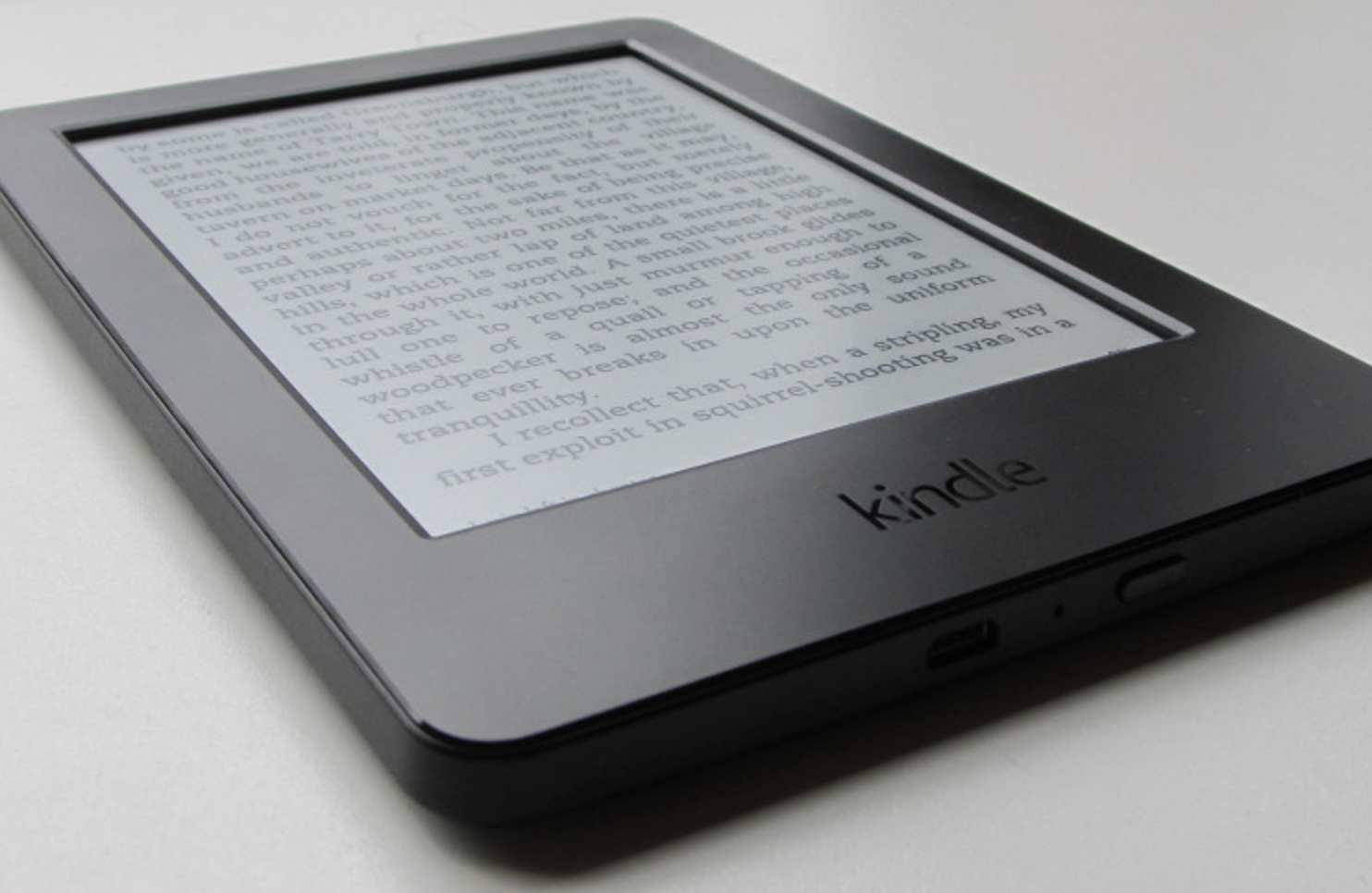

The Kindle cost $399—high compared to other e-readers—and sold out within a few hours. It was an immediate, huge hit with the market. It solved all of the pain points that the team had known about e-readers going in. It also offered readers things they didn’t even know they could ask for, like an entire library on one device.

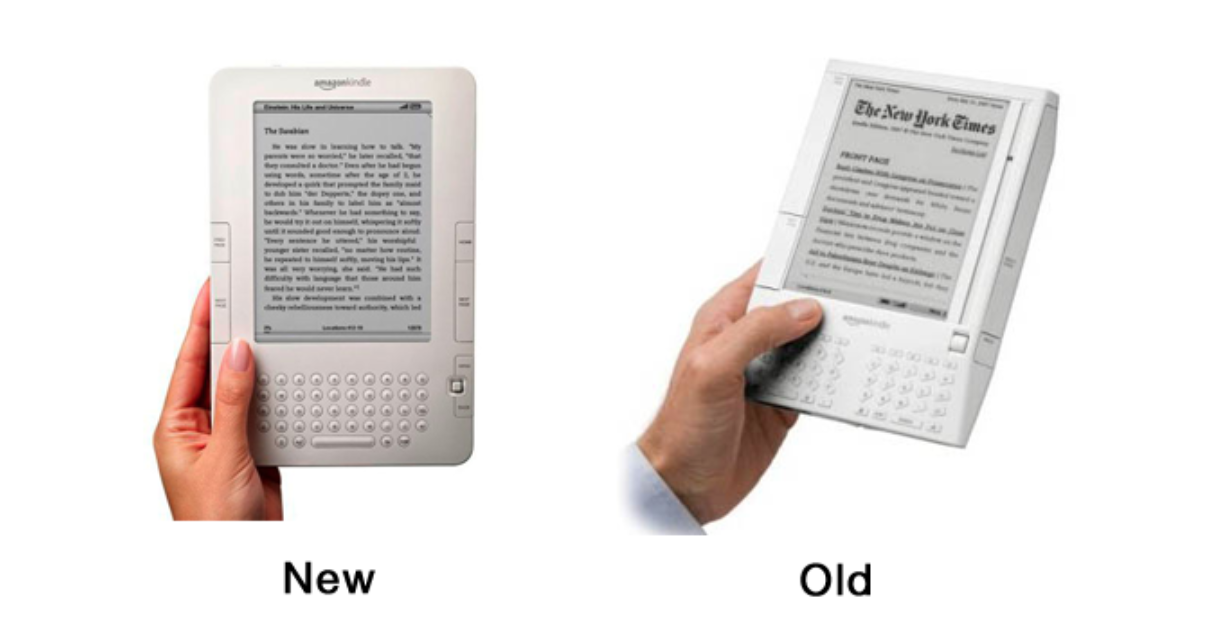

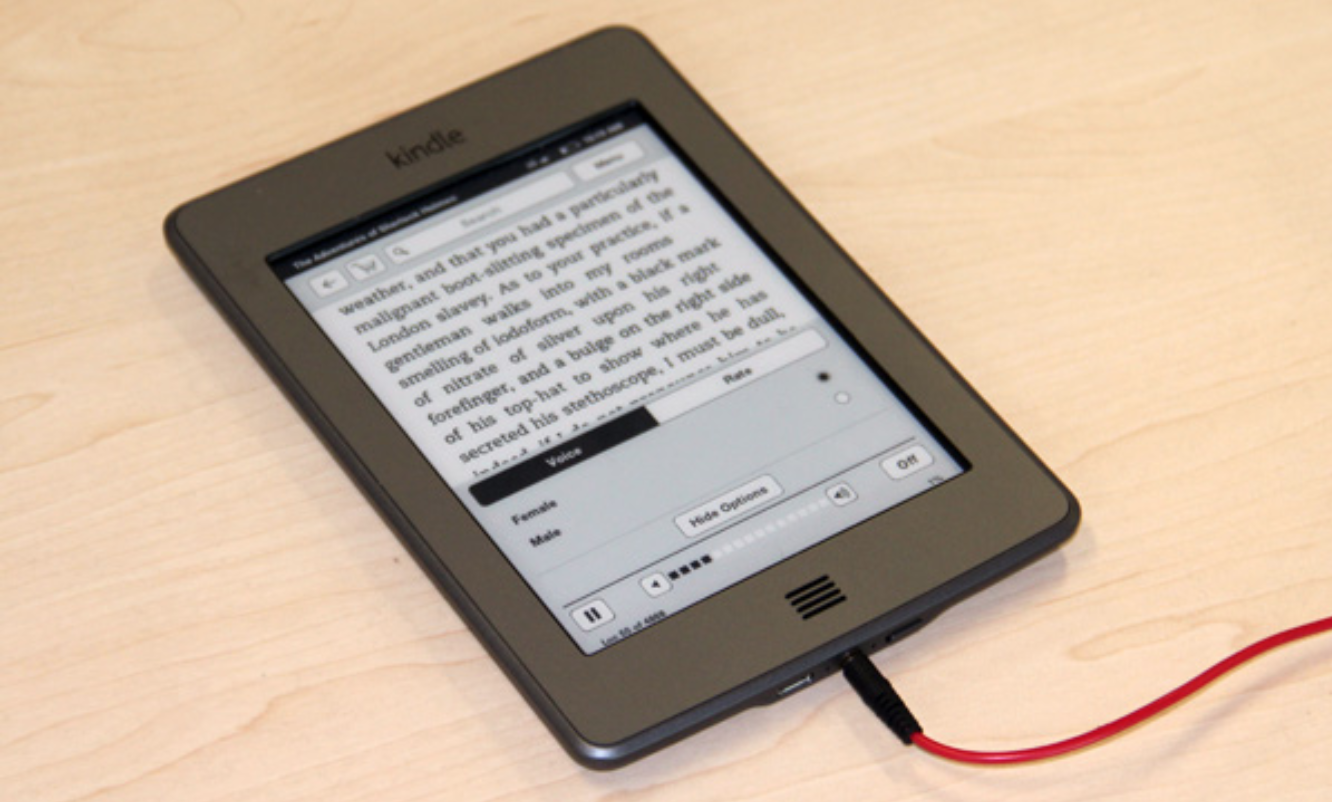

2009: After consistently selling out, restocking, and selling out again on the Kindle for a year and a half, Amazon released a second edition in February of 2009. They’d gotten user feedback on improvements they could make and the Kindle 2 was a bundle of those small adjustments. It had a better design and was more symmetrical, featured faster page turns, more storage, and could read to you with a new speech function. At $359, it was slightly cheaper than the original version.

[Source]

In June of that same year, Amazon released another version of the Kindle: the Kindle DX. This version was bigger at 9.7 inches. In addition to improved tech specs, memory, and storage, the Kindle DX was a step forward because it supported PDF files with a native PDF reader. This, in combination with the bigger screen, was important for Bezos’s vision that the Kindle would one day be used for publications like cookbooks, magazines, and newspapers—not just long-form books.

[Source]

[Source]

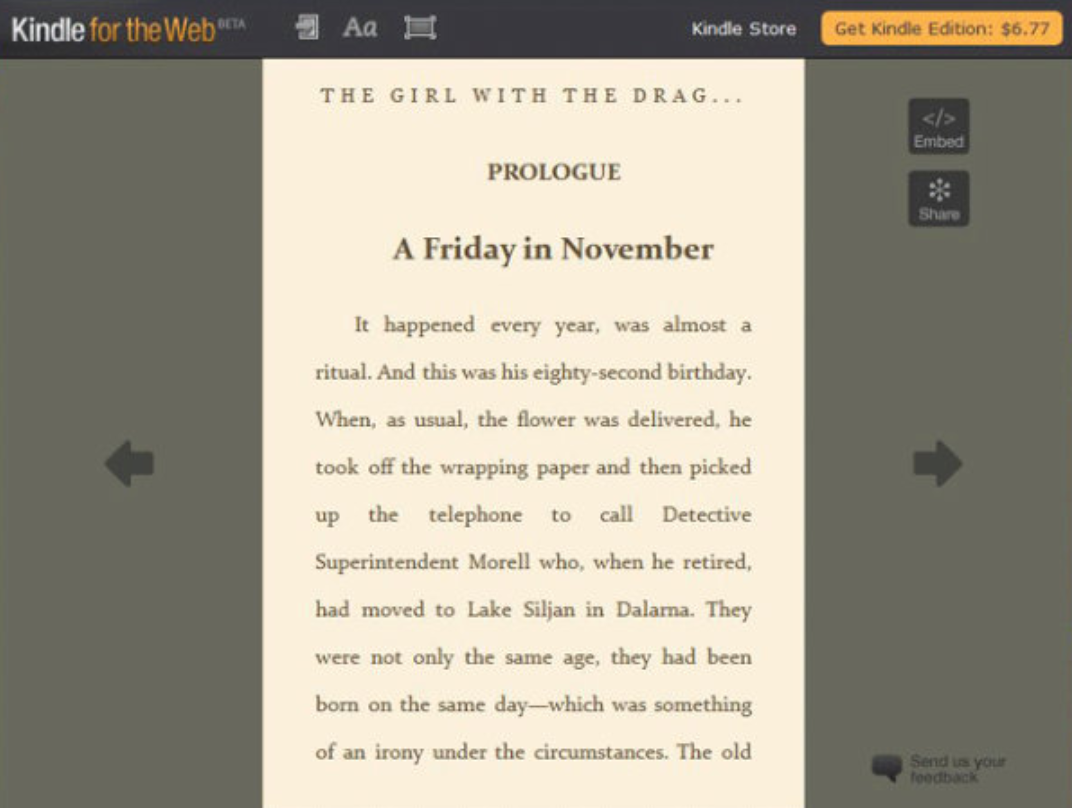

Later that year, Amazon introduced Kindle for the web. Now people could read free samples of books in browsers without a Kindle device or an Amazon account. It was really helpful for online shoppers looking for books because they could sample the first few pages for free. It improved Amazon’s online book-buying experience and tied the Kindle user’s experience more directly to the online shopper’s experience.

[Source]

[Source]

[Source]

[Source]

[Source]

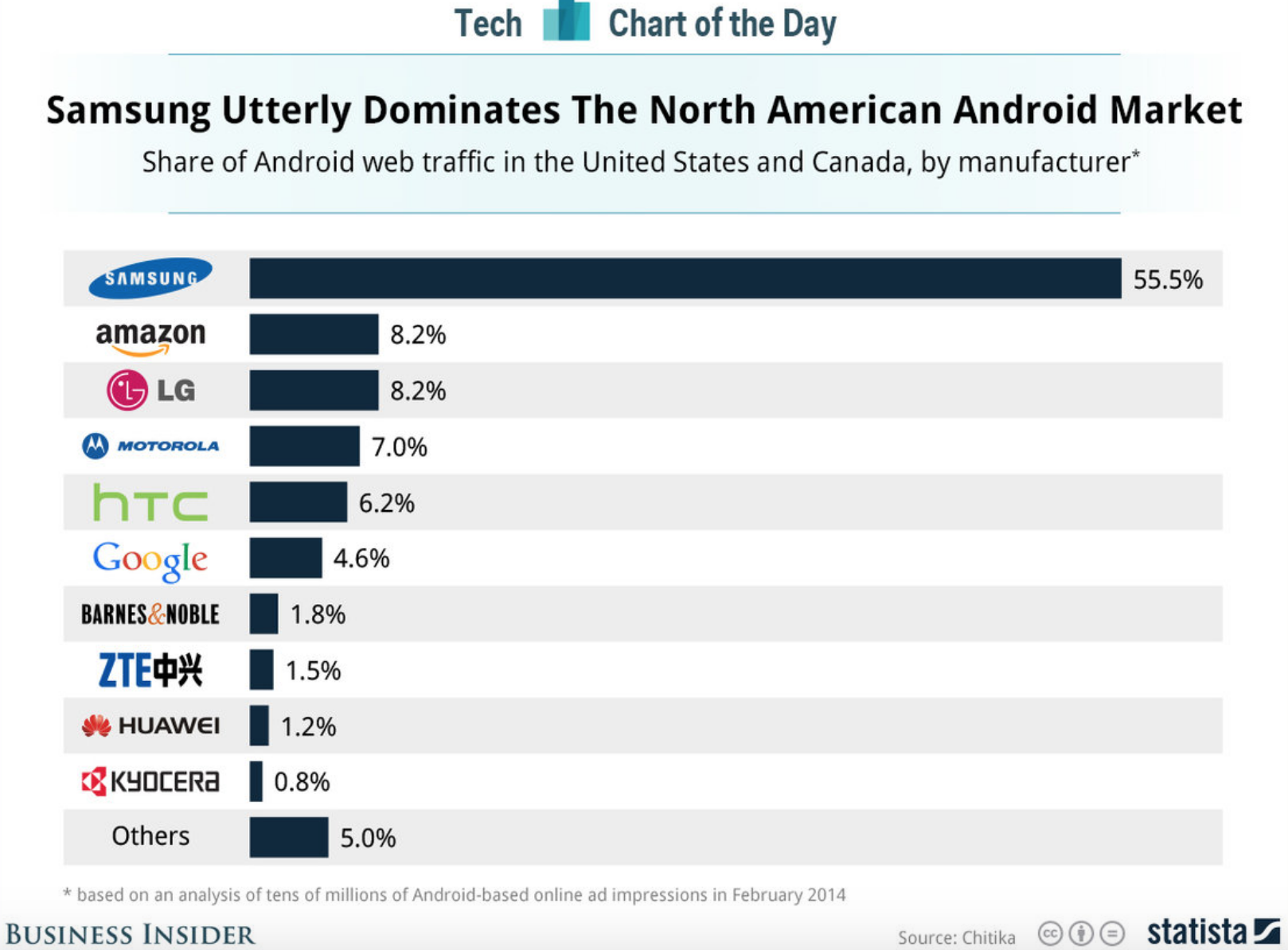

Amazon is second only to Samsung in Android web traffic, thanks to their line of Kindle Fire tablets. [Source]

[Source]

In 2013, Amazon revamped the device and released the Paperwhite 2, which was “subtly better and faster,” with improvements like a more responsive touchscreen, a faster processor, and whiter and brighter light.

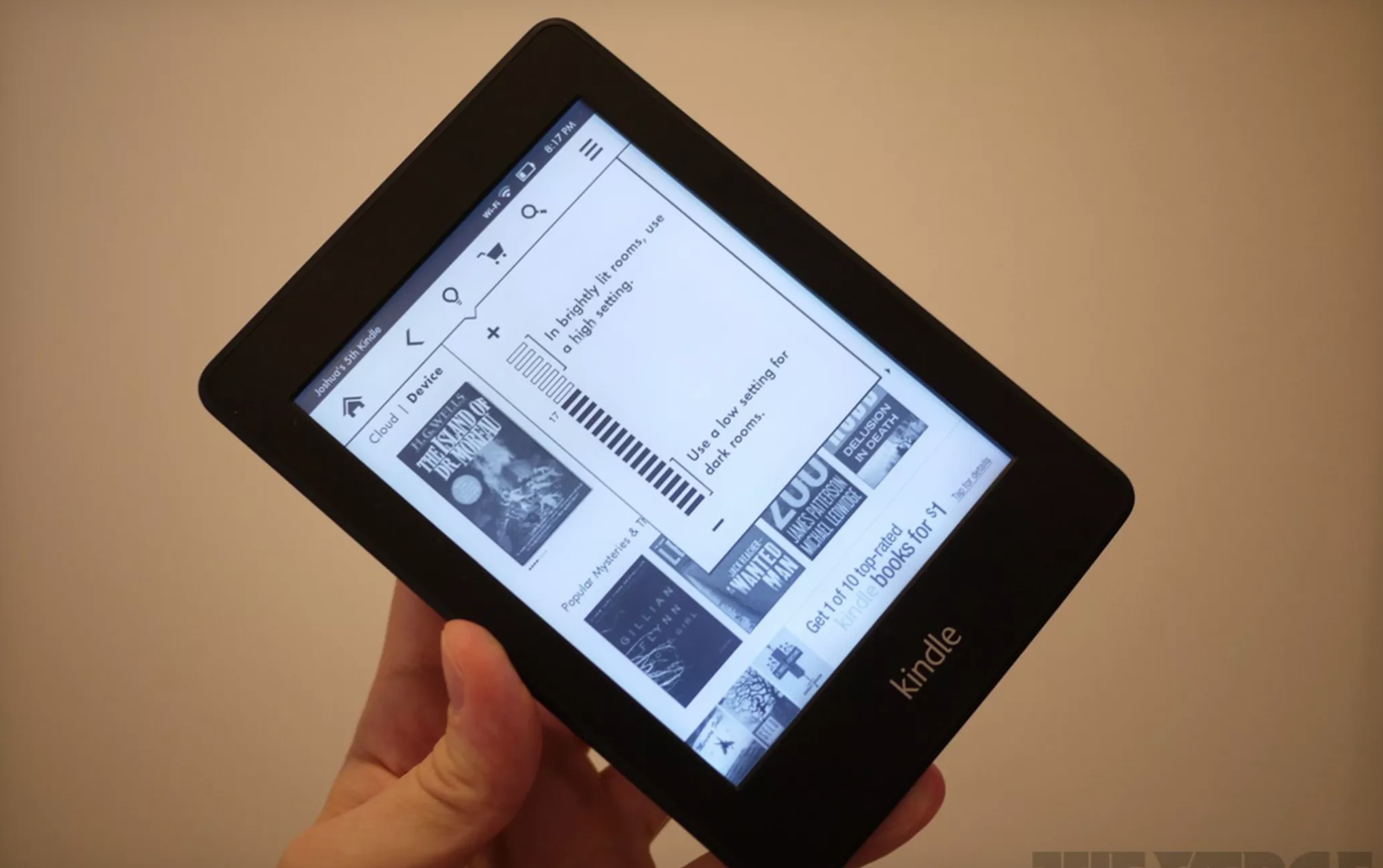

2014: Prices for Amazon Kindle started very high and slowly climbed down over the years with different models. In October 2014, Amazon released its lowest-priced and most pared-down model yet, the 7th Generation Kindle. This model went for $79 for the basic version, which included ads. Users complained that the design of the device was a little bulkier and less comfortable to hold than previous models. But the 7th Generation did succeed in capturing an entirely new market of e-reader users at a much lower price point. It made reading on a device more accessible than ever.

[Source]

[Source]

Realizing the importance of design and user experience were key for Amazon’s product development process. This was a huge component of Amazon’s success that set them apart from other e-reader companies. Above all, they respected the book as a device. Chris Green, VP of Design at Lab126, said that the team knew “we can never be better than paper, but we can be as compelling.” This mentality helped the team to prioritize UX and user needs, creating a beautiful reading experience and converting readers into users in a market where no one had successfully done that.

Significant benchmarks along the way confirmed their success. For example, in 2011, ebooks outsold hard copy books on Amazon. Even Jeff Bezos was surprised at how successful their ebook had been—and how quickly.

“We had high hopes that this would happen eventually, but we never imagined it would happen this quickly. We’ve been selling print books for 15 years and Kindle books for less than four years.” – Jeff Bezos

More numbers confirmed the success. According for Forbes, Amazon sold around 20 million Kindle devices in 2013, which brought in around $3.9 billion in revenue.

But the Kindle’s success wasn’t only about the design or the tech specs. Amazon made a lot of changes behind the scenes that created the scaffolding for the Kindle’s success. For example, they had to change the way they interacted with book publishers in order to make ebooks an attractive idea in the first place. Amazon made the Kindle closed and proprietary and inhibited sharing options, which put the power of distribution back in the hands of the publishers rather than those of the user. To jump-start sales, they also committed to a short-term sacrifice of their portion of ebook profits to kick them back to publishers.

Publishers weren’t the most profitable links in the overall ecosystem, but Amazon recognized their power to make or break the rise of ebooks in general. This was key for Bezos: making decisions to sacrifice profit in the short-term in order to prioritize long-term sustainability. Bezos was okay taking a loss on ebooks. He said, “We have a lot of experience in low-margin and high-volume sales — you just have to make sure the mix [between discounted and higher-priced items] works.”

This sweet spot between the right ideology (prioritizing customers and taking short-term losses to cater to publishers) and execution (constant iteration) helped make the Kindle more popular than Amazon ever imagined. But the next challenge was to see if they’d ever come to re-create that success and build another consumer product.

2014-Present: Amazon shifts focus to digitize the next frontier — the home

“We want to be a large company that’s also an invention machine.” – Jeff Bezos, Letter to Investors

In Amazon’s Lab126, the Kindle was known by another name: Project A. Amazon’s next big hit was Project D.

The Kindle was Amazon’s first dive into product development. Its success proved that even though Amazon was an e-commerce company, they could make consumer devices that people loved. They rode the high of the Kindle and began work on several other projects. Their most recent work has completely changed the way people use technology today and created an entirely new computing platform for consumers.

Unfortunately, they had to strike out a few times first. In a letter to investors, Bezos wrote that “failure and innovation are inseparable twins.” Amazon learned this painful lesson in 2014 when they tried to release Project B, the Fire Phone.

[Source]

The phone was a clear departure from Amazon’s number one priority: to put the customer first. Instead, Bezos had tried to compete with Apple and Google and make something “cool,” and it totally flopped. Amazon took a $170 million loss on the phone and an even bigger morale hit at Lab126.

Luckily, at the lab, independent teams worked on different projects. While one team was building the Fire Phone, a different team was working on Project C. This project is more mysterious because it never made it to the market. The only clue as to what they were working on came from some augmented reality patents tied to Lab126 employees in 2010-2011. People speculated that Amazon was trying to build a home device with AR. The project may have been too expensive, or too difficult, or too crazy — but it was abandoned and no press about it was ever released.

Instead, Lab126 began Project D as an offshoot. Since Project B was dead on arrival and Project C had never even made it to the market, Amazon had stricter parameters around Project D’s development. It would focus on just one aspect of smart home technology—voice recognition—and it would be designed as a much simpler and cheaper consumer device. They initially imagined selling them at $50 and manufacturing them for $17.

To aid development, Amazon hired people from the speech recognition company Nuance, and bought voice recognition startups Yap and Evi. As they worked on the device, they ran into technical problems like processing power and response latency, which made the product much harder and more expensive to build than they’d anticipated. Even in development, the team wasn’t exactly sure what the purpose of the device was beyond a “smart music speaker.” Instead, they were driven by Bezos’s certainty.

“There was almost an irrational expectation around the functionality of the device. Jeff had a vision of full integration into every part of the shopping experience.” – Lab126 engineer

As the device became more complicated, the release had to be pushed back. For three years, they expected to ship in six months.

The team was anxious about releasing the device, which they would call the Echo, activated by the wake word “Alexa.” Apple and Google had been working on voice recognition technology long before Amazon and clearly had a leg up. But the main difference was that while Apple and Google used voice recognition primarily to aid smartphone use, Amazon didn’t have that option because their phone never took off. Instead, they had to do something totally different with their voice recognition technology. It was a huge risk, but also a huge opportunity to create a new category and win over the market, just like they did with the Kindle.

Let’s take a closer look at how Amazon released the Echo and has iterated and expanded upon it in the last several years—and how they’ve changed the way that people will interact with home devices in the future.

2014: In November, Amazon finally announced their device, the Echo, alongside the voice recognition technology, Alexa. It was only released to a small group of people.

[Source]

2015: Amazon released the Echo and Alexa to the public. Users had been on waiting lists since the previous year, and Amazon built hype around the device just by making it so exclusive. Finally, in June, anyone who wanted one could buy one for $179. Early users were excited by the Echo and its unique place in the market because there was no other device exactly like it. In addition to answering questions, it tied easily into Amazon’s other services like music and shopping. Amazon had also added updates to the device since they released to invitation-only groups in 2014. One of the biggest new developments was that Alexa would function as a hub for the smart home. This idea for smart home connectivity didn’t come until late 2014, but as one Lab126 engineer put it, the idea was “some [Bezos] grew to embrace, aggressively.”

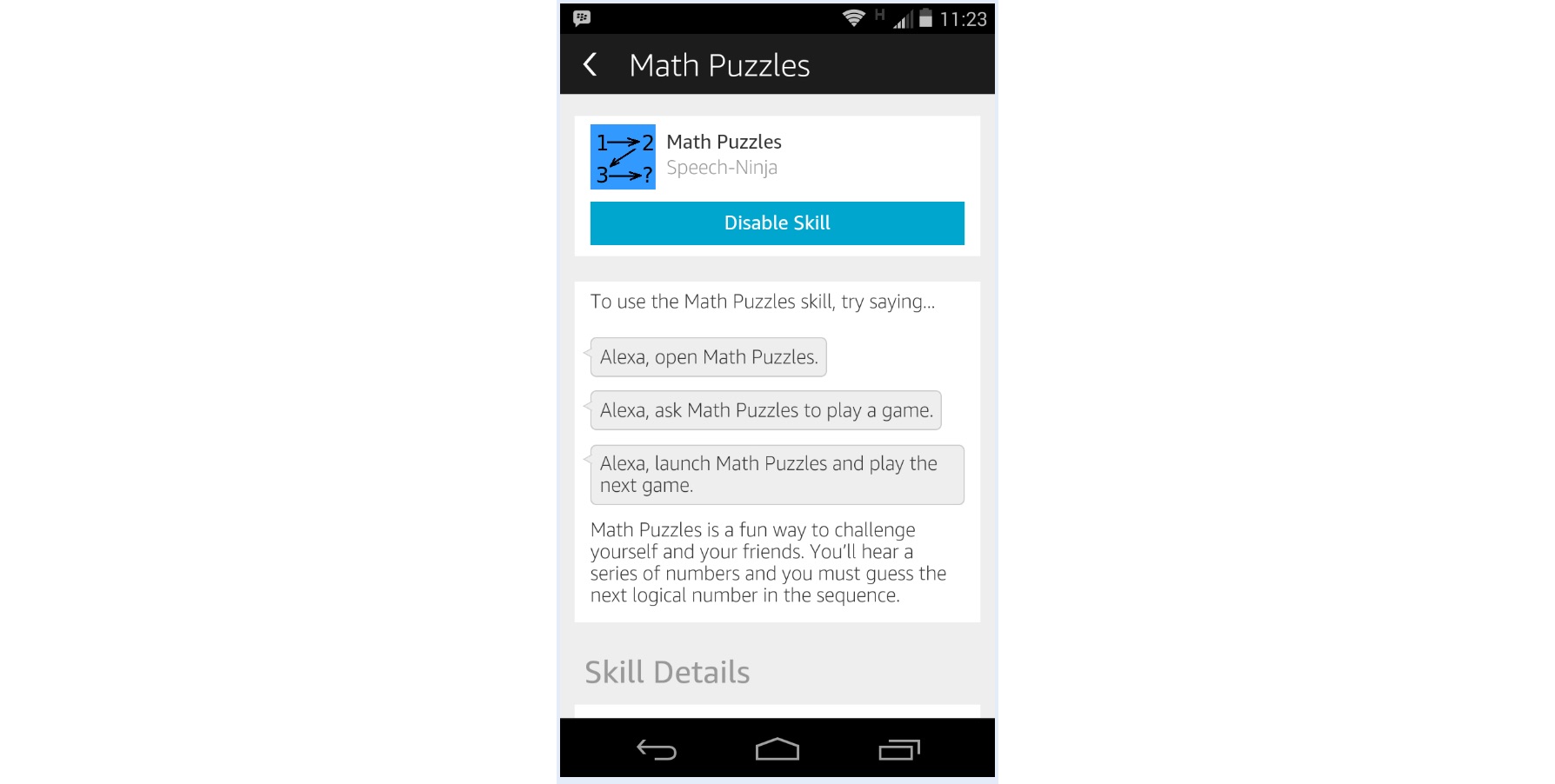

Later that year, Amazon released the Alexa Skills Kit (ASK), a kit of tools and self-serve APIs that would allow third-party developers to build apps for Alexa (or “skills”) that used voice recognition technology. Quickly, developers started building their own creative apps around everything from games like fortune-telling to educational apps like math puzzles.

[Source]

2016: In October, Amazon released the Echo dot, which was actually an early idea in the development of the Echo that was shelved in favor of the larger 2014 version. The Dot was a smaller, 1.3-inch-tall hockey-puck shaped device that could be placed around the house to pick up voice commands in other rooms.

The Dot was smaller and cheaper than the original Echo. For those who didn’t want to buy the more expensive device, the Dot made it even easier for customers to bring Alexa’s technology into their homes. For people who already had an Echo, it was an easy cross-sell to level up their smart home experience. Customers loved the $50 price point and loved that the Alexa technology was just as powerful and functional as the technology in the larger version.

The same year, they also released the Amazon Tap, which was another Alexa-enabled device designed to be a speaker above all else. It had a better speaker system than the Echo with higher audio quality.

[Source]

[Source]

The second generation Echo also had improved listening capabilities and an aux jack that let users connect the system to external speakers. But the most exciting change for users was that the device was now only $99.

The Dot continued to be hugely popular with customers — especially when it was discounted. On Black Friday of 2017, it was one of Amazon’s top two products sold overall.

Inspired by the Dot’s success, Amazon continued releasing a slew of Alexa-enabled devices. In May, they released the Echo Show, a smart speaker with a 7-inch touchscreen display. People liked it and appreciated that the display was only meant to complement Alexa’s technology, not act as a fully-functional tablet.

[Source]

[Source]

Echo Spot [Source]

In some ways, the success of Alexa has surpassed that of the Kindle. With Alexa, Amazon is creating an entirely new technology platform and a new way for people to interact with technology going forward. Earlier this year, the New York Times wrote, “Alexa has the best shot of becoming the third great consumer computing platform of this decade — next to iOS and Android, a computing service so ubiquitous that it sets a foundation for much of the rest of what happens in tech.” In fact, it’s even paving the way for new standards and expectations.

“In five years, my Echo will say, ‘Hey, it’s about time to go to the airport. Should I get you a car?’ And I’ll just say yes.” – Julie Ask, Analyst at Forrester Research

But in other ways, the development of Alexa mirrors the development of the Kindle. They’re constantly iterating both products—in recent years, Amazon has continued to release new versions of the Kindle, like the Paperwhite 3 (2015), the high-end Kindle Oasis (2016), and the Kindle Oasis 2 (2017). With each new version, the technology is more advanced, the user experience gets better, and the standards for e-readers get higher.

The successes of both the Kindle and Alexa were also hugely dependent on an obsession with the customer and learning what the market wanted. With Alexa, this happened in small ways—for example, the team initially couldn’t decide if they should include a remote with the original Echo. They decided to release the remote with the device and observe whether people actually used it. When they saw it was unpopular, they quietly removed it from outgoing Echos.

But it also happens in huge ways. For example, Amazon keeps an internal list of customer suggestions for new Alexa skills. They rank them by popularity and use the list to determine what features they should ship next. It’s a radical way of building products and evolving features that can’t work for every company.

The most interesting thing about Amazon’s Alexa is that it’s always improving on a week-to-week basis. Customers have come to expect constant improvements, and Amazon delivers. They’ve created a level of trust between their brand and their market that allows them to take crazy risks and this allows them to (sometimes) build the thing that’s going to shape the future of tech.

What’s next for Amazon?

Amazon’s ambition is limitless, which makes their trajectory totally unpredictable.

Amazon doesn’t have the linear progression of product development and expansion like a lot of SaaS startups. They’re an online book seller that became an e-commerce platform that became one of the leading innovators in consumer technology products. It’s not totally clear what they’re going to do next.

But there’s no doubt that Amazon will keep experimenting and iterating and trying to make big ideas come to life. Like with Project B and Project C, Amazon might create some failures or even dream up projects so crazy that they never even make it to the market. I’m looking forward to seeing more trials and failures, which are exciting because it means that they have a vision that we, as consumers, can’t see yet.

The next big moves for Amazon are completely scattered and in some ways even seem disconnected. This just speaks to how horizontal their reach has become. Here are three ways that I see room for Amazon to grow and develop in the future.

1. Smart Food Delivery: 2017 was a big year for Amazon beyond just product development. In August, they purchased Whole Foods for $13.7 billion. This was a huge piece in giving them all the tools to create the fastest, cheapest, and most convenient food delivery service. Amazon is using Whole Foods to get physically closer to their consumers—instead of shipping items out from warehouses with Prime, they’re making it possible to ship from the store two streets down. This means customers get exactly what they want—the food they love, shipped fast, without having to leave their home.

In February they took another step towards making this possible by rolling out free two-hour food delivery for Prime members in four U.S. cities. As they make delivery faster and more convenient, they’ll put pressure on other grocery and food establishments to do the same. In the future, they could even sync up a user’s delivery preferences with smart home devices to create a refrigerator that automatically places orders and restocks itself.

2. A Free Smartphone: Amazon learned a lot of lessons from their failed phone. They tried to compete on design and price point with the iPhone, but they were already the latecomers to the smartphone market. Without some other really strong value proposition, they didn’t stand a chance. There is another way that Amazon could compete, though: with a really low price point. Their Fire tablet, for example, offers accessibility to Amazon’s services, but is priced much lower than the iPad. They could offer their phone at a comparably low price point—or even offer it as a free perk or upgrade bundled with another product.

Bezos himself strongly believes in prioritizing efficiency over margins. If Amazon reimagines their phone as a low-profit way to bring a pocket Amazon device to users, they’d have much greater distribution and would actually have a spot in the smartphone market to compete.

3. Augmented Reality: In late 2017, Amazon announced a new feature on their iOS app that lets users visualize a product in three dimensions in their home or office. This gives them a better sense of what an object will actually look like in the context of their environment before they order it. The new feature is one of the most compelling use-cases for AR in the shopping experience and it seems like it genuinely may drive more shopping revenue. It’s a small start but it could have big waves. Knowing that Amazon had previous AR plans during the development of their mysterious Project C, it’s likely that we’ll see more AR innovation from them as they continue to integrate it into the shopping and the smart home experience.

One Echo reviewer in 2015 said, “To me [Echo is] bringing technology from Iron Man, Tony Stark’s house into your own.” Now innovation is only accelerating. It’s likely that Amazon will be the company that makes science fiction real for us. And even if they don’t, the company that does build the future’s new technology platform will likely do it on AWS. So really, Amazon wins either way.

3 Key Lessons to Learn From Amazon

Not every company is going to become Amazon. But that’s not the point of learning about how they make great products.

Many of the principles that underlie Amazon’s work are pretty basic. Bezos talks openly about them in interviews and letters to shareholders. They’re not things like capital or media attention—even though those help. They’re things like keeping a Day 1 mentality or treating every day like it’s the very start of the company’s journey. Not all of these principles that work for Amazon are going to work for other companies. But if startups can identify the ones that translate the best, they can build the same strong foundation for product development.

Here are the three key lessons that startups can take away from Amazon’s product development principles:

1. Work Backwards

Amazon is always trying to learn more about their customers. They’ve put such an effort into it that their latest products like the Echo, the Spot, and the Look are criticized for spying on customers.

From a consumer standpoint that may be unsettling, but from a product development standpoint, it’s genius. User research doesn’t just help them personalize your shopping experience or remember your music preferences. It also helps them understand your usage patterns, your habits, what kind of devices you like, and ultimately what kind of product you’ll want to buy next.

It’s so important for any company to have a strong product vision that is informed by customer research. As you use analytics tools and talk to your customers, keep the mentality that the customer is always dissatisfied. Constantly probe for problems, see where there are shortcomings, and imagine what they would want next.

This is how you’ll achieve that infamous fortune-telling skill: knowing what customers want before they do.

2. Focus where you know you can win

Whether you’re Amazon or a single-person startup, you have to know who you are and define your strengths. When you don’t understand where you can win, that’s when you’ll mess up.

Amazon messed up their Fire Phone because it clearly wasn’t a market where they could win, but they tried to go there anyway. It ended up being a very expensive decision.

On the flip side, they knew that they could win in the e-reader market because no one had conquered it yet. Similarly, since they couldn’t use their voice recognition technology for a virtual smartphone assistant, they turned to where no one else was going yet: the home.

If you’re a growing company, you need to define the place where you can win with your team and with your customers. Internally, it creates a more focused vision and stronger morale. But it’s also very important to make sure that your messaging and marketing to the outside world are consistent with your internal vision. Keep in constant communication with your customers and be honest with them about your product intentions. By establishing that consistent messaging and line of communication, they’re more likely to be forgiving when you mess up.

3. Be okay with taking losses if they net a win

One of Amazon’s core business principles is efficiency over profit. They’re more interested in building long-term and direct relationships with customers than making money on particular products. More generally, this translates to long-term thinking, which is important to any company of any size.

Amazon makes this a priority on every level. They do it when making decisions in building specific products. For example, when the team first imagined the Echo, they believed they’d make a $33 profit at a $50 price point. By the time the product went to market, with everything the team believed it needed to be great, Amazon was taking a loss at a $150 price point. But they believed that the Echo would help them win over a new market and create the foothold for a new smart home ecosystem. It was worth it.

They also do this on a larger scale. Bezos acknowledges the failure of the Fire Phone as a whole as something necessary to the successful development of other great products.

Looking back, I’ve made short-term decisions (like getting rid of the free plan at Crazy Egg) that helped drive revenue at the time but probably stunted the company’s growth. Financials are important to an early company, but at the same time you can’t sacrifice long-term growth for short-term revenue. When you’re making big product development or pricing decisions, consider the 1-year, 2-year, and 5-year effects. Zooming out will help you prioritize the things that set your business up for long-term growth.

Will we soon be living in Amazon’s world?

People within and outside of the tech industry love to speculate about how large Amazon’s influence will grow. The answer isn’t totally clear. But the fact that they’re even asking is a testament to how far the company has come.

Just over 10 years ago, Amazon was an e-commerce platform. Now, they’re considered one of the tech giants among Apple and Google that are shaping the way that consumers interact with technology. This trajectory alone shows the power of their product development process. With two unrelated consumers products—the Kindle and the Echo Amazon became a tangible part of consumers’ worlds and continues to mold the products to be what people really want them to be. I’m excited to see what they’ll do next.