The Story of Crazy Egg: How We Succeeded By Analyzing Our Competition

How do you come up with new solutions, new products, and a new way of helping others in life and business?

I’ve come to believe that the answer lies in figuring out what problems are worth solving—and how to do so better than any competitors.

During the creation of Crazy Egg, one of my first SaaS businesses, I learned about the best pre-existing research frameworks to use when developing a product, and created a few of my own along the way.

The final framework we ran with didn’t emerge as a neat package, ready for us to use. We developed it during the mayhem of launching a new business. The first thing my co-founder, Neil, and I did was identify a problem with an existing product on the market (Google Analytics).

Even though we identified a problem, we knew we needed to determine whether our proposed solution could turn into a viable business. That was our next step.

As we forged ahead, we developed a process of discovery:

- Problem Research: Identify a problem worth solving.

- User Research: Understand how people are solving this problem currently.

- Competitor Research: Thoroughly research the competitors within the space.

Research is the basis of this process. Building a product without doing your research is like cooking a meal blindfolded. Even if it doesn’t turn out terribly, the chances are high that the final result won’t taste nearly as good as it could have.

Nowhere is this more true than in the early stages of your startup. Every early decision has implications that grow in significance as the business scales.

You will likely pivot along the way, as I’ve often done in my businesses. But you don’t grow solely as a result of pivots. Growth is the result of sound and informed decision-making early on.

Obviously, there’s no way that you can know for sure. There have been plenty of times in the past where I’ve wondered, “Did we make the right decision?” or “I’m not sure what decision we should make.” But the one thing you can always depend on to help you parse through those moments of uncertainty is the reliability of research.

Effective and thorough research removes much of the worry, confusion, and stress involved in starting a company. Research gives you the confidence to move forward, and the ability to execute at a rapid pace.

Here’s more detail about each of the three stages in the discovery process we used to identify a problem worth solving, and then figure out how to build a viable solution:

Phase 1: Problem Research – Identify a problem worth solving.

The first phase of research involves identifying the problem(s) you should be solving.

The genesis of Crazy Egg took place when my business partner and I identified a limitation in Google Analytics. At the time, we were running a marketing consulting company. Our clients needed data, and Google Analytics was a competent tool that provided most of what we needed.

There was one exception. This was the single limitation that frustrated us, and by extension other users, too.

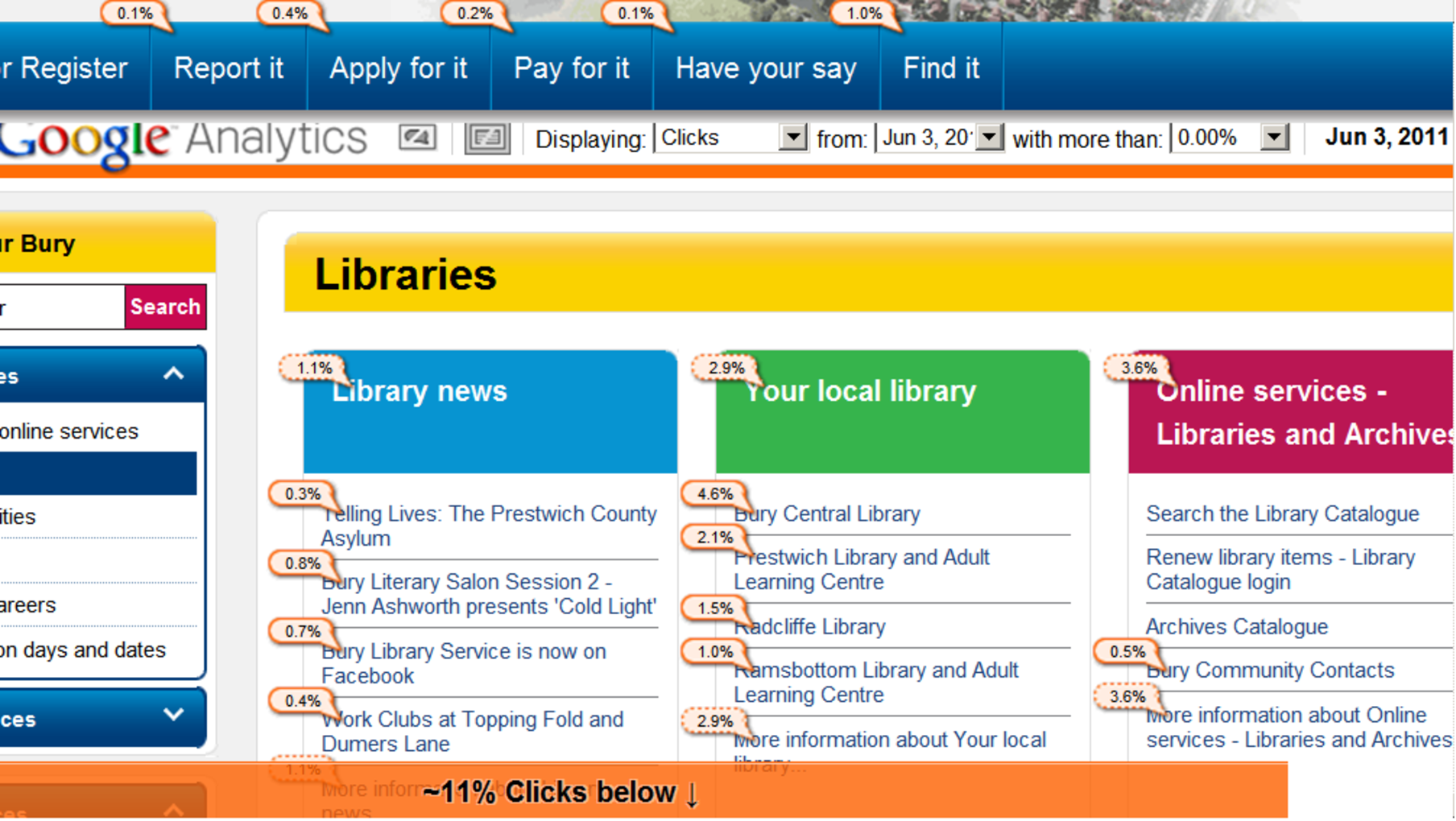

One of the Google Analytics features at the time was called Site Overlay. The idea behind the tool was to show you the percentage of visitors clicking on certain areas of the page.

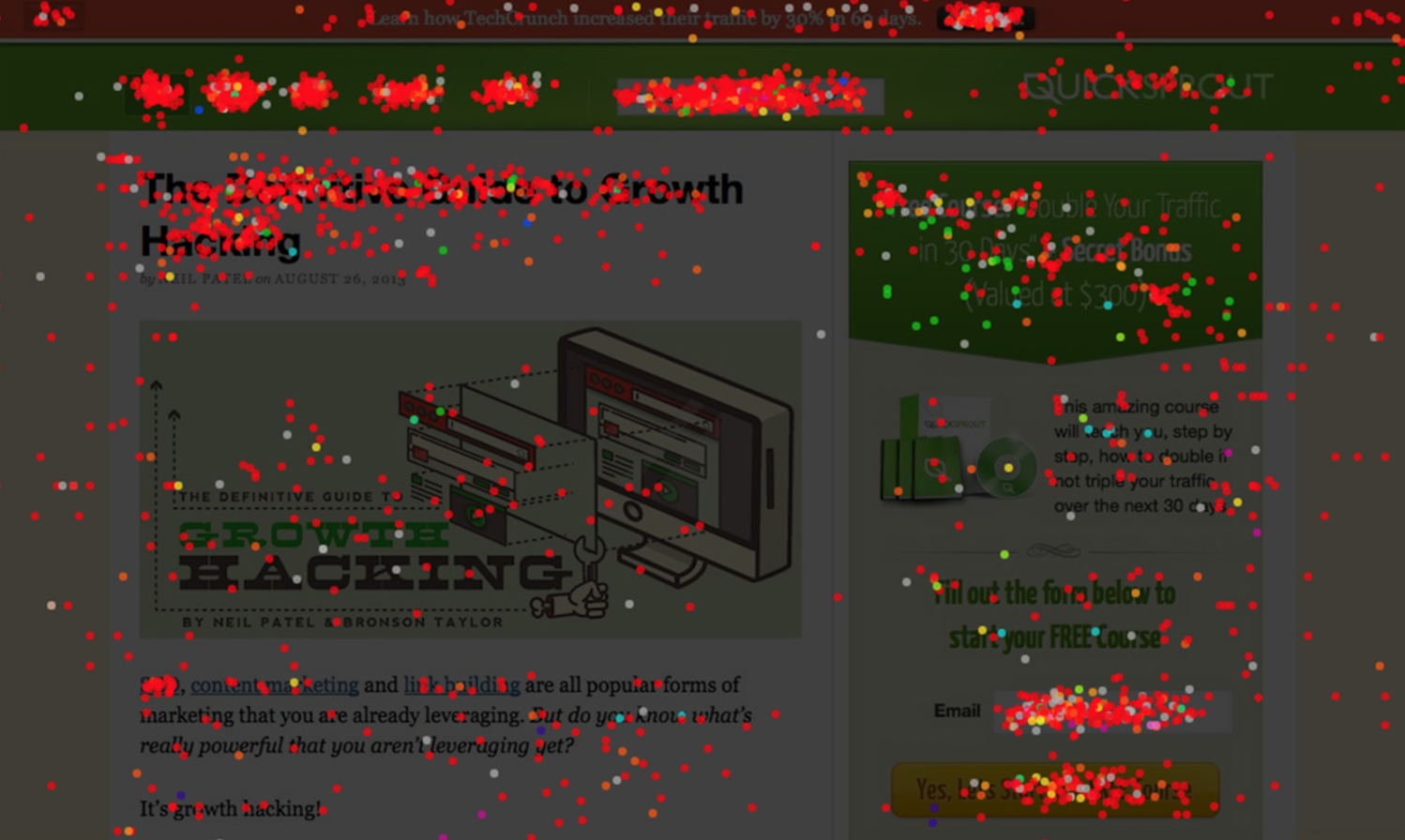

Site Overlay showed page-level data, not every click. If users were clicking on an area that Site Overlay wasn’t tracking, such as the form field in the screenshot below, then Site Overlay would not display that information.

Notice how Site Overlay tracks the clicks on this page. There is no click information on the form field:

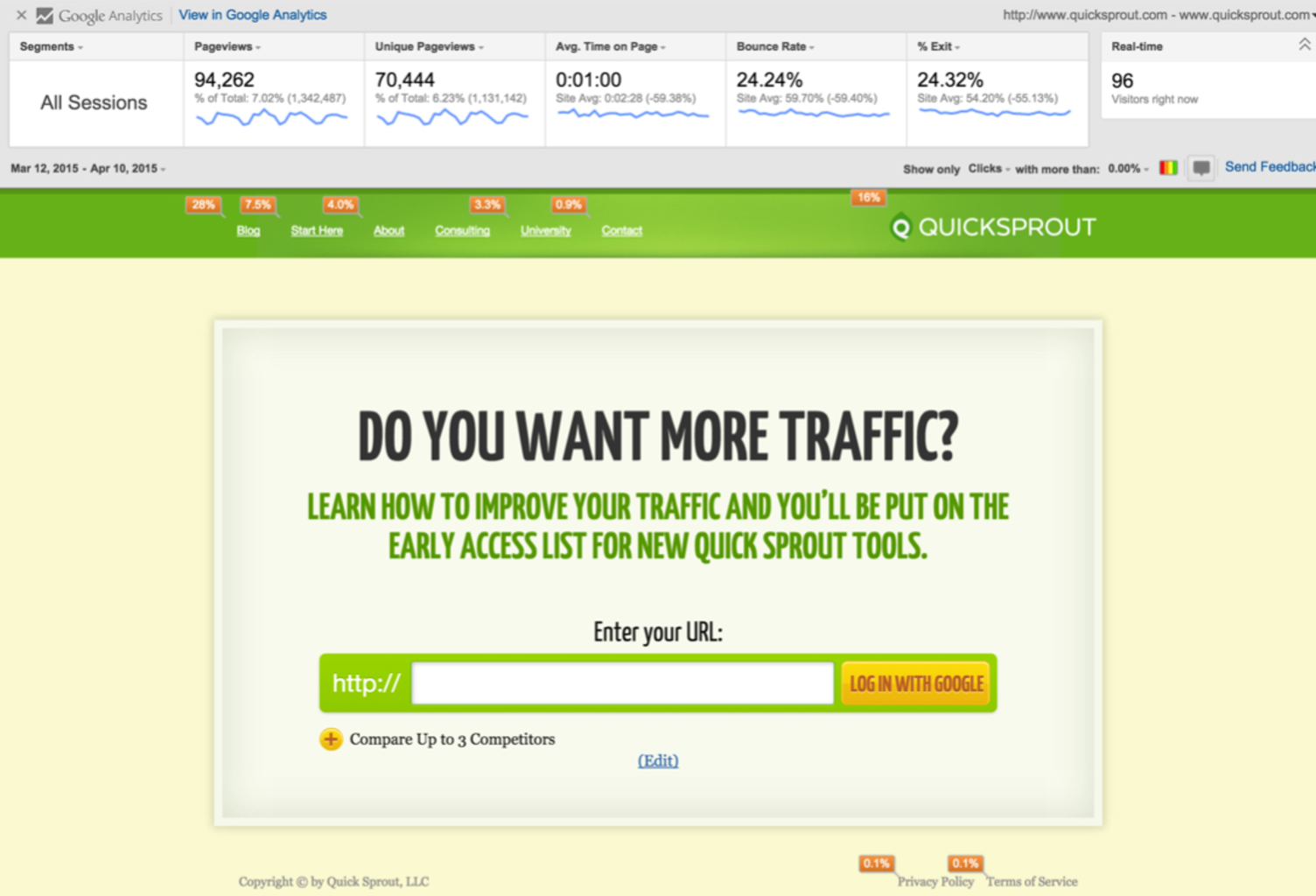

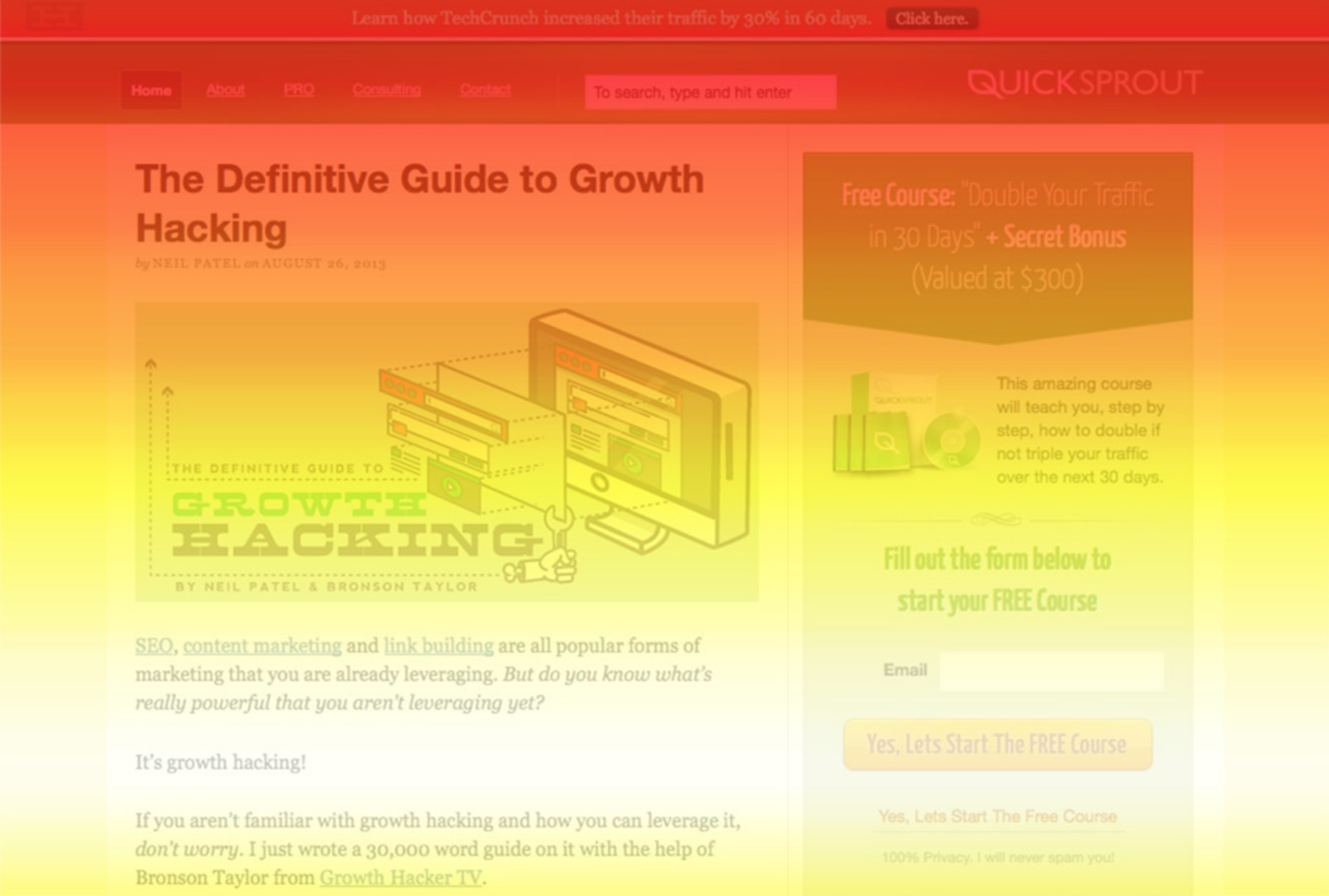

We envisioned a tool that would show users all of the clicks on any given page, like this one (actual screenshot using a Crazy Egg heat map):

If users were clicking on other parts of the page (and we discovered they were), this would be important for designers and marketers to know. Designers need the kind of user data that can lead to improvements in user experience. Marketers can benefit from this data to gain insight into key performance metrics.

We identified an opportunity to solve a problem and create a helpful tool that would track every click on the page.

This opportunity eventually gave rise to the Crazy Egg product.

That’s just one example. There are thousands of potential problems that a startup could attempt to solve. Generally, there are two types of problems: a macro problem and a micro problem.

Macro Problems

A macro problem is vaguely defined. This lack of definition isn’t a bad thing; it simply means that it will take longer to narrow down a solution and eventually solve the problem.

Here’s an example: PayPal founders identified a macro problem in the world of digital security, but it took them some time to define an exact solution. At first, the company was intent on improving security for handheld devices. It pivoted to become a money transfer business, and later developed into a payment portal for eBay.

It wasn’t until 2007, nearly ten years after its founding, that PayPal developed into the mature online payment system that it is today.

Macro problems are not always acute pain points. Instead, they appear as an unsatisfactory status quo. Any problem that fits into that category requires disruptive innovation.

What is disruptive innovation? Simply put, it’s a major change in an existing market that produces a new market.

Here’s another example: the status quo of the Internet in the early 1990s was a disorganized mass of information. Noble attempts in the form of Archie, AltaVista, and Yahoo! were launched to improve the unsatisfactory status quo.

Archie was a prehistoric search engine. It indexed archived files on intranets, to help people find specific files.

Then Google came along, embarking on a “mission to organize a seemingly infinite amount of information on the web.” Instead of organizing information only, they monetized the effort, allowing advertisers to pay for ads that would appear at the top of certain search results.

Google disrupted the industry, giving rise to SEO, PPC, and a new world of digital marketing.

Micro Problems

While trying to solve macro problems can be thrilling, going down that path usually requires more money, time, and talent. The majority of startups focus on solving a micro problem, instead. Crazy Egg is the perfect example. As active users of Google Analytics, my co-founder and I identified a shortcoming within a pre-existing (and very popular) product.

Launching a SaaS built on a micro problem shortens the time it takes to get to market, and allows for greater clarity as you are strategizing your marketing approach alongside product development.

The research in phase one—identifying the problem to be solved—is likely related to pain points you’ve either personally had or observed others having while using pre-existing solutions.

If you possess a founder’s eye for problems, and an engineer’s passion for solving them, you’ll more readily be able to identify and commit to an important problem you are invested in solving. That’s how I felt when we started to build Crazy Egg; I was experiencing the problem first-hand, so spotting the need for a better solution was easier.

Phase 2: User Research – Ask questions to understand how people are currently solving this problem.

When a problem exists, people usually do one of two things: 1) They continue despite the problem (usually a macro problem) or 2) They try to solve the problem (usually a micro problem).

This is where you put on your researcher hat and dig in. You need to understand how users currently try to solve the problem you’ve identified by asking the right questions.

One good way to ask these questions is through surveys. You can start with broad questions, such as, “What tools have you used or are currently using?”

Depending on the problem you are solving, you’ll want to ask specific questions that help you get the information you need to think through what a viable solution might look like.

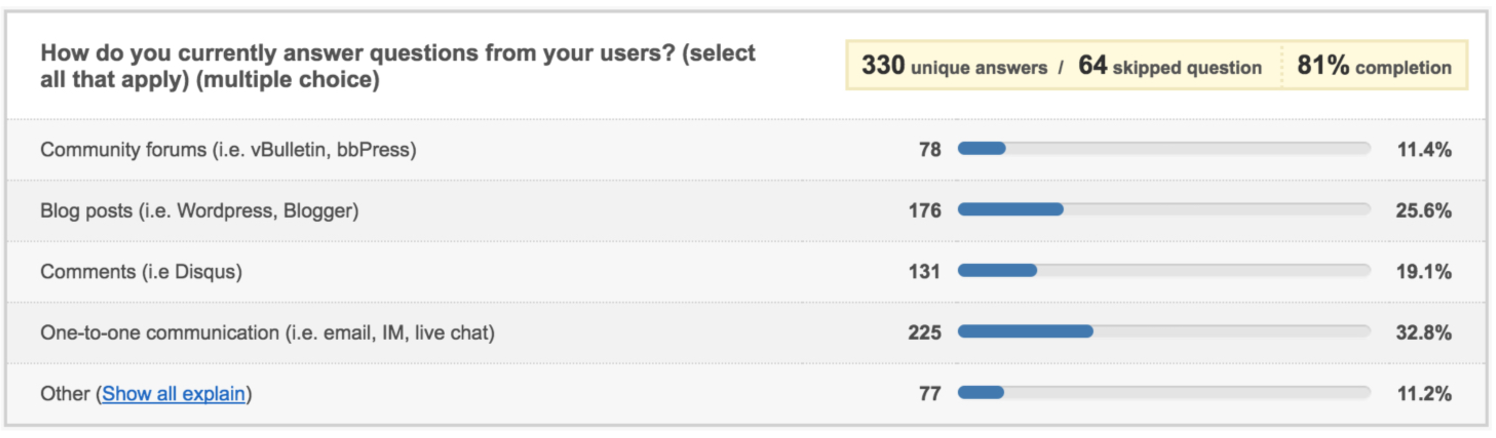

I helped a friend who was building out a tool during this phase of his research process. He wanted to understand how businesses were handling customer service. To get him those answers, we asked questions like “How do you currently answer questions from your users?” Here’s what it looked like:

You can follow the same question pattern when you create your survey question. That pattern looks like this:

How do you [solve your problem]?

Here are a few more examples of questions you might ask to get at how people currently solve the problem you’ve identified:

- How do you schedule meetings across multiple time zones with multiple people? (Meeting Planner)

- How do you collate all the critical website metrics for a weekly reporting process? (TapClicks)

- How do you make sure that your home is warm enough when you come back from a vacation in the winter, without wasting money on your energy bill? (Nest)

- How do you find out exactly where your business is losing money due to unused SaaS subscriptions?

By this point in your research you have begun to formulate your solution to the problem. You have an idea for a product.

Even though research is essential, it’s not without its dangers! One issue I’ve fought against is confirmation bias. I want so badly for my belief about something to be true, that I misinterpret new evidence as confirming my belief.

It’s easy for startup founders to get caught in such a cognitive fallacy. We spend so much of our time and attention on solving problems, and without even intending to, we lose sight of the plain evidence in front of us.

The user research phase never truly stops. You should constantly be learning from and understanding your users.

At some point, however, it’s important to move from researching how potential users are solving the problem to understanding who else is trying to solve the same problem.

It’s time to research your competition.

Phase 3: Competitor Research – Thoroughly research the competitors within the space.

It’s likely that there are other players in your space—existing businesses or startups that are also attempting to solve the problem.

One of the most valuable phases of your research involves understanding: 1) who these companies are, and 2) how they are attempting to solve the problem.

This final phase of research could take longer than the previous two, depending on how many competitors are in your space.

When we founded Crazy Egg, there were only a few other competitors in the space. Crazy Egg was one of the pioneers in heat mapping technology. Today, plenty of other SaaS products include heat mapping.

In the early days with Crazy Egg, our research focused on indirect competition, such as Google Analytics and Omniture. We wanted to understand how our users thought, what they needed, and how our product could be as useful as possible.

As time went on, more and more SaaS products created their own heat mapping tools. We realized the importance of researching our competition, so we fully investigated each tool to understand its merits and drawbacks.

The research led us to refine our own product and add additional features. One feature was the confetti display, which segmented clicks by referral source and search term.

We also improved our scroll map technology, which showed exactly how far down on a page users were scrolling, as well as providing a visual display of abandonment and jump-off points.

In order for Crazy Egg to thrive, we had to continually research and learn from our competition.

Questions About Research

I’ve followed this three-step process often. Many times, my research proves that my startup idea is no good, which means I can scrap it without wasting time and resources unnecessarily. Other times, my research gives me the green light, and I’m able to execute. Regardless of the outcome, I’ve found it important to follow these steps whenever I launch something new because it always ends up saving me time and helping me avoid costly mistakes. I’d highly encourage you to do the same.

Along the way, I’ve encountered some common questions about the research process. Here they are, along with my answers:

How should I carry out this research?

Simple surveys are the best format that I’ve discovered. Essentially, you want reliable, accurate, and trustworthy data. Ideally, that data comes from potential users.

One benefit of a survey-based approach is that you are creating a core group of early adopters — people who may be interested in the product once it hits the market.

Should I hire an outside agency to do this?

There are plenty of agencies who will be glad to do market research on your behalf. Such agencies provide a valuable service, and it’s a good idea to use their services to augment your own research process.

However, I strongly recommend that you personally, as a founder, carry out or direct this three-phase research plan yourself. Why? Because there is no substitute for being face-to-face with the data if you want to gain a visceral understanding of your competition and users (which you should).

How long should I spend on research?

This process takes days, at a minimum, but more likely weeks or months.

How often should I do this kind of research?

At the very least, you should perform this research exercise in the earliest phase of your startup. I also recommend it any time you launch a new feature, release a new product, or face a question about the viability of your product in the marketplace.

You may not need to conduct the full-orbed three-step process every quarter or every year. However, you should never stop researching your customers and competition because the world is constantly changing and your business needs to change with it.

Takeaways

This research process is simple and straightforward. Just remember the three discovery phases:

- Problem Research: Identify a problem worth solving.

- User Research: Understand how people are solving this problem currently.

- Research: Thoroughly research the competitors within the space.

A final note: I spend a lot of my time meeting SaaS founders. My goal is to help as many people as possible, both personally and through the businesses I help create.

One of the things I’ve noticed is that a lot of people waste time reinventing the wheel. They are asking the same questions: How do we come up with the right product? How do we know what the market wants? Who is the competition in this space?

These questions have been asked before. Many people have answered them. The solution is not in endless brainstorming and gut-feelings. The solution lies in research.

Ask the right questions first—and be willing to potentially pivot your current idea if the research leads you toward building a different solution than you originally anticipated.