Why you shouldn’t ignore your competitors

This post is written by Marie Prokopets, co-founder of Product Habits and FYI, and features slides presented by her co-founder Hiten Shah at the 2019 Appealie SaaS Conference.

I’ve been told countless times to ignore my competitors.

- Don’t waste time thinking about what they are doing.

- Don’t look at their latest features.

- Don’t worry about them.

Basically, pretend they don’t exist. Instead, I’m told to focus on my customers.

That’s been the common advice for years. Repeated by the likes of Peter Thiel, Sam Altman, Dharmesh Shah and Jack Ma.

This advice made sense in the past. That’s because in the past it was much harder to create SaaS businesses. A lot of the services we can use to make our lives easier, like Zapier, Webflow and Airtable, didn’t exist. There also wasn’t as much competition. The MarTech 5000 only had 150 marketing technology solutions. And of course, people were afraid of creating copy-cat products. They wanted to be different. Have what was called a “unique value proposition.”

Things are much different today.

Competition sprouts up constantly. That includes totally new competitors fresh off the heels of seven and eight figures in venture funding. Plus it’s not uncommon to have new competitors come from companies in adjacent spaces that decide to build something in yours.

There is a constant stream of new competitors. And if you don’t do anything about it, they might eat your lunch.

That’s not to say that you should obsessively watch what your competitors are launching and doing out of fear. Instead, you should have a process to research your competitors in order to get deeper insights on what really matters: your customers.

Customer opinions and desires don’t stay the same. They are constantly changing, molded by the market. That’s why product/market fit scores change over time. Customers expectations change. And you have to change with them.

Competitor research is one of the keys to learning about your customers and staying abreast of their problems, wants, needs, and desires.

What can you learn about your customers from your competitors?

Researching your competitors can offer you a deep understanding of your customers. It can be your secret weapon. Or, your painful weakness.

My co-founder Hiten used to ignore his competitors. He didn’t pay attention to them because, at the time, he didn’t realize just how much he could learn about his customers through them. And because of that he made a number of serious missteps with his business KISSmetrics.

But if you limit your research to just your most obvious competitors, you’ll be missing out on valuable insights. There are four different types of competitors that you should be learning from:

Direct competitors – These competitors are solving the same problem for the same types of customers as you are or plan to.

Indirect competitors – These competitors don’t do exactly the same thing as you. They service the same customer you do, and offer a solution that is somewhat close to yours, but not exactly the same.

Alternative solutions – Manual solutions that customers use to get the same job your product does done. Think spreadsheets, pen and paper, books, checklists, consultants and contractors.

Multiple tool solutions – When multiple tools are stitched together to solve the problem your product solves. For example, customers could be using tools like Zapier and Airtable to help automate manual processes.

As an example, here’s a breakdown of each of these types of competitors for FYI:

- Direct competitors – Products that let you search for documents across all the apps and accounts you use.

- Indirect competitors – The document apps themselves, since each app lets customers search for documents within that app.

- Alternative solutions – People create wikis with links to all their important documents.

- Multiple tool solutions – People who keep multiple browser windows open so they can be signed into different G Suite accounts on each, in order to easily search for documents when they aren’t sure which account they are on.

You can learn a tremendous amount from each type of competitor, and you should be making sure to dig into products and solutions in each of the four categories when you do competitive research.

Here’s what competitive research can teach you about your customers (and why you shouldn’t skip it!):

The competitors and alternatives – What products and alternatives are customers using to solve their problems today? Which are they using most frequently? Which are they using least frequently? When do they use each one and why?

Target customers – What types of customers are competitors targeting? Where do they see the opportunity? What types of customers gravitate to each competitor?

Features – What competitor features do customers care about? Why do they care about those features? Are there features customers don’t care about? Are there features that customers want but don’t have?

Customer sentiment – How do customers feel about competitors? Why do they feel that way? What do customers love the most? What do they dislike? What are the specific words customers are using? What are customer expectations? Are competitors meeting customer expectations?

Over a quarter of companies aren’t doing competitor research

I’ll start with the bad news. 28% of companies aren’t doing any formal competitor research. They might glance at a competitor’s tweet or look at their website once a year. But nothing more.

That means over a quarter of companies are missing out on learning about their customers through their competitors. Ouch.

We asked people who said they weren’t conducting competitive research why they aren’t doing it. The main reasons why fell into 5 categories:

- “We don’t have the time to do it.”

- “We keep an eye on competitors, but don’t have a clear process for researching them.”

- “Competitor research is not a priority.”

- “We’d rather focus on our customer’s needs instead.”

- “We don’t have much competition.”

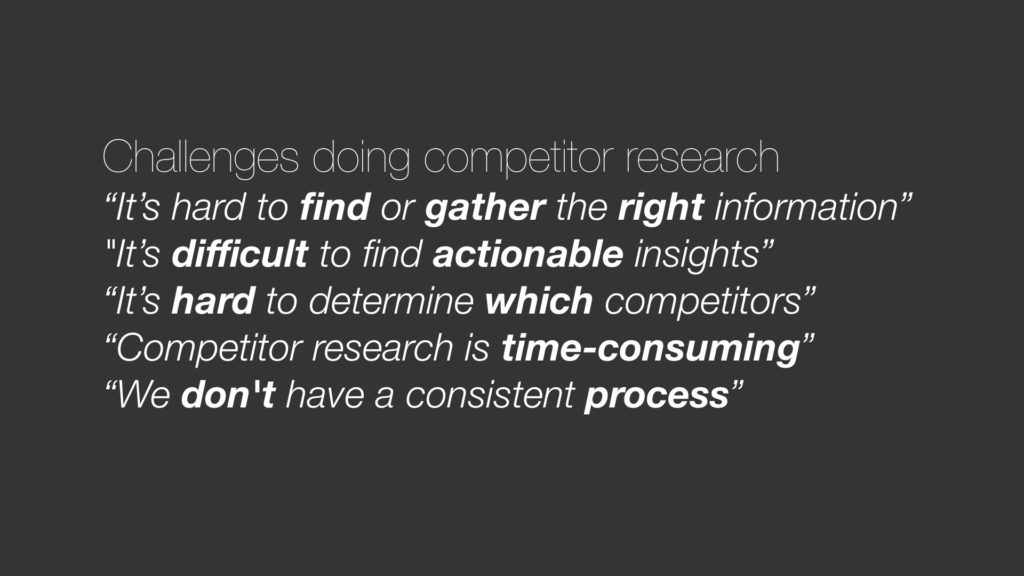

For the companies that said they do conduct competitor research, there were a host of challenges mentioned.

The challenges included difficulty finding the right information and getting to actionable insights, trouble knowing which competitors to focus on, the time consuming nature of competitive analysis, and conducting competitive research without a process.

The number one challenge people mentioned was that finding useful information when conducting competitor research was difficult.

“Info is scattered across the web. Most of it is junk. The good data points are behind walled gardens that cost a fortune like Pitchbook.”

Others said they struggle to find actionable insights once they complete the research.

“Knowing what to do with competitor insights. We know things, now what?”

“Discerning the absolute trove of information down to key points”

The majority of companies are doing some form of competitor research

And now, the good news! 72% of the companies we surveyed said they did competitor research.

Except… they aren’t all actually doing real competitor research.

Even though the majority of companies said they are doing competitive research, much of the research that’s being done isn’t deep or focused enough.

A little Googling here. A quick glance at a competitor’s product. That’s what most people are doing. Very few people are actually talking to or surveying customers.

We asked people to list any and all tools or services they have used for conducting competitor research. Over 50 tools were mentioned:

- 24% Google/searching the web

- 11% Signing up for a competitors’ product

- 7% Customer interviews and surveys

- 6% Review sites and social media

- 6% Ahrefs

- 6% G2

- 4% Similarweb

- 4% Capterra

Googling was the number one method used. Meanwhile, only 7% were doing customer interviews and surveys about their competitors. And only 6% were looking at customer reviews on G2.

It’s no wonder the top challenge people have with competitive research is finding useful information. They aren’t actually looking in the right places. Googling and going through a competitor’s marketing site and product will only give you a small sliver of the overall picture. You’ll end up having a skewed perspective of what they are doing and miss out on a lot of learnings about the customer.

The four methods of doing competitive analysis to learn about your customers

There are four key methods to learn about your customer using competitive research.

- Interviews & Surveys

- Competitor Websites

- Competitor Reviews

- Customers Switching

We use each and every one of these methods at FYI, and recommend that you use at least two or more. Although you can use only one, using multiple methods will give you a much more robust understanding of the customer.

Interviews & Surveys

This is our favorite way to do competitor research at FYI. Talking to customers about your competitors and getting customer responses to surveys will teach you more than any other competitive research technique.

It is the single most valuable thing you can do when it comes to competitive research.

You’ll learn the exact words people use when talking about your competitors. Why they are using them, if they used them in the past and switched to another solution, and how they feel about the competitors.

At FYI, we start with surveys before we move to interviews. This helps us identify who the competitors are before the interviews. It gives us a baseline understanding of which companies we should be digging into more.

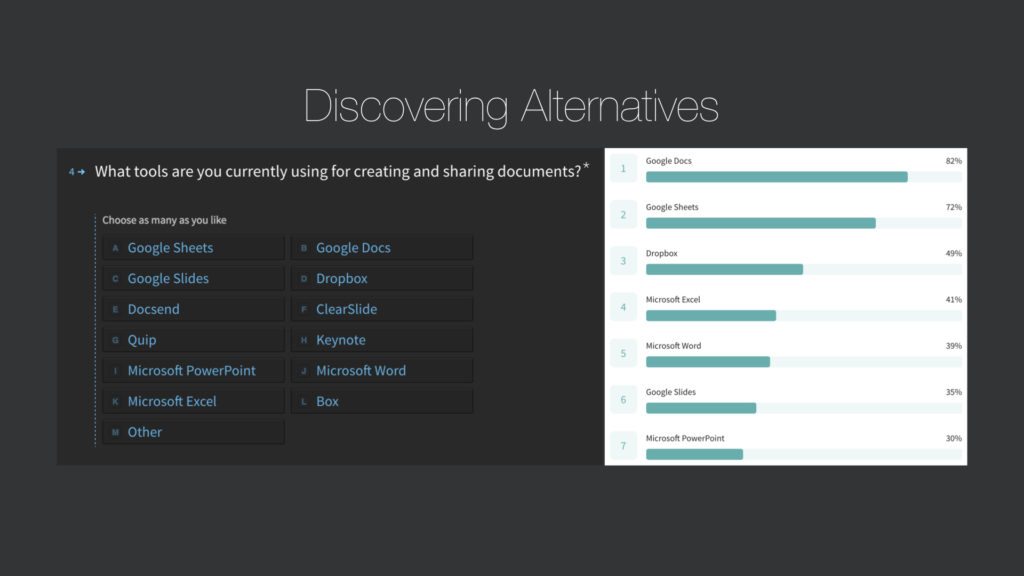

When we first began digging into the document category, we wanted to understand which apps people were using the most. Asking people “What tools are you currently using for creating and sharing documents” helped us discover that G Suite and Dropbox were the two most popular apps.

This survey gave us a baseline understanding of who the indirect competitors were. In our interviews, we got much more color about each of these apps, plus learned about new up and coming apps like Notion that were barely mentioned in the surveys (this was before Notion 2.0 was launched).

Here are a few of the things you’ll want to learn about during customer interviews:

- What products and alternatives are customers using?

- How do they use different products with each other?

- What do customers think of the tools they use and their features?

- How are they using them?

- Are they using many tools to solve the problem, or just one?

- Have they ever switched tools/processes? Why?

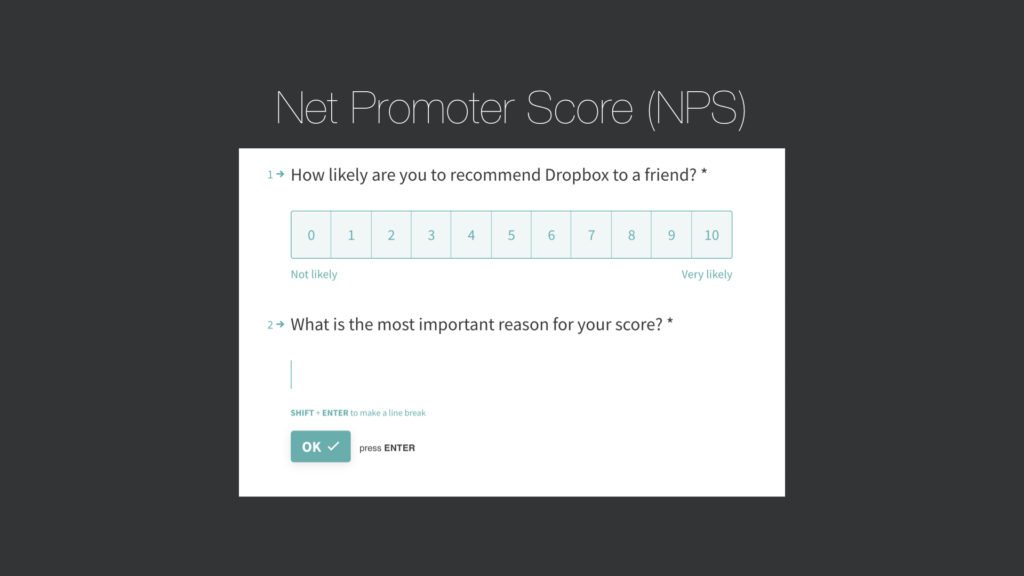

Later, we followed up with Net Promoter Score (NPS) surveys to learn more about customer sentiment for each of the popular apps. We made sure to ask not only the 0-10 scale standard NPS question “How likely are you to recommend [product] to a friend?”, but also “What is the most important reason for your score?” This open-ended question gave us rich qualitative information to analyze.

And we didn’t just do these surveys once. We now have NPS scores of our indirect competitors from 2017, 2018 and 2019. This helps us understand how customer sentiment changes over time, and lets us get NPS for newer products like Notion, Airtable and Coda too.

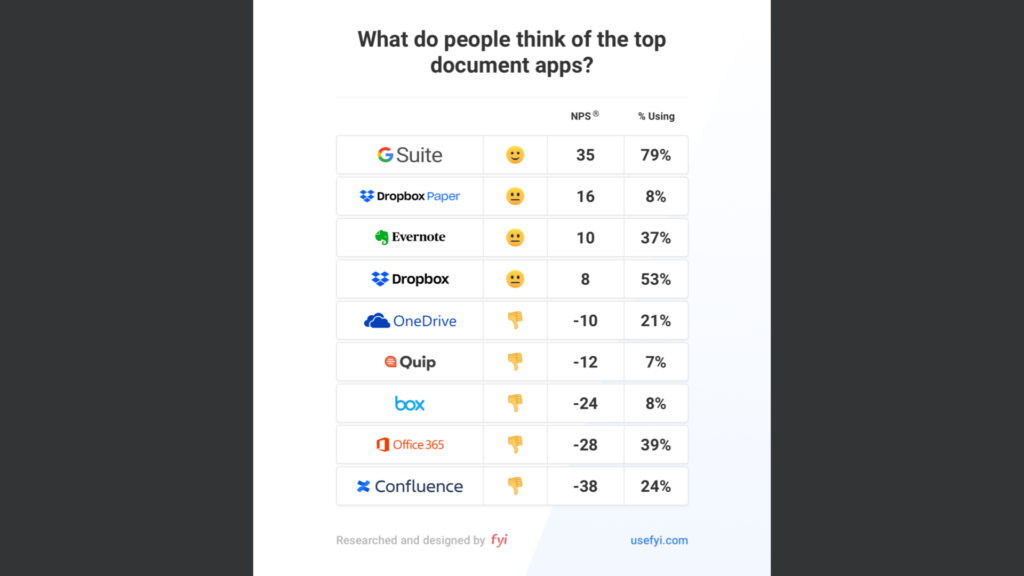

In doing NPS surveys, we learned something huge – that the document category has fairly low Net Promoter Scores. G Suite, one of the market leaders, only has an NPS of 35, which means its customers are satisfied, but just barely.

Competitor Websites

You’d be surprised what you’ll find on your competitor’s websites.

- The all-too-common crappy never user-tested homepages ✅

- The rare, amazing polished and user-tested homepages ✅

- Lists of customers ✅

- Pages devoted to particular competitors ✅

- Pages laying out company strategy ✅

Don’t underestimate what you can learn about you customers and market from your competitor’s marketing copy. There’s a wealth of information that’s there and publicly available, just waiting for you to explore.

And of course, use discernment. The point isn’t to believe your competitors have it right. It’s not to rush to copy them. It’s to learn as much as you can about your customer.

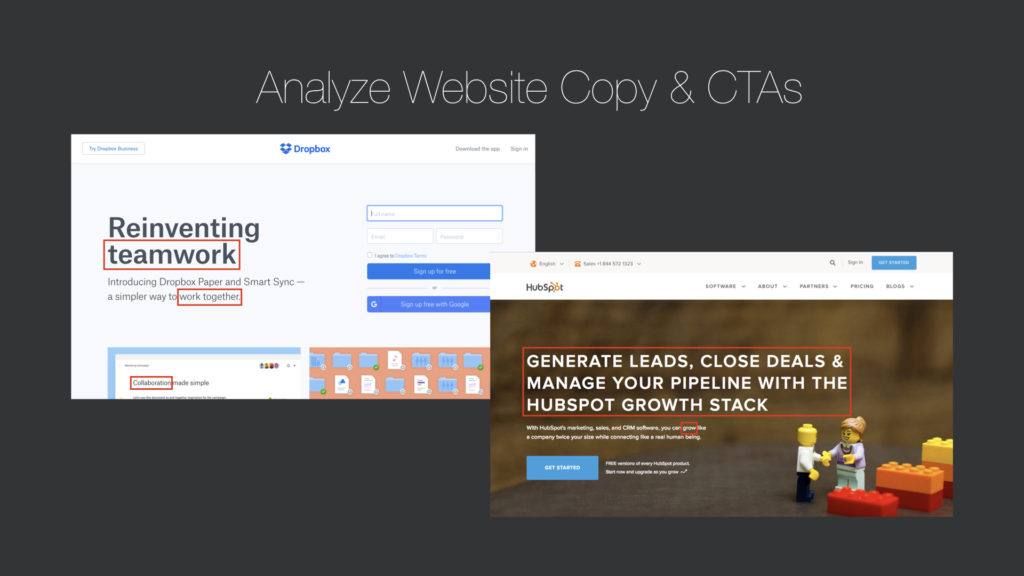

Here’s the checklist we follow whenever we analyze competitor websites:

- Homepage & Landing Pages – By looking at the home page and landing pages, you’ll be able to see the product’s value propositions. You may also see the types of customers they are focused on.

- Testimonials & Case Studies – Testimonials and case studies can teach you who the competitor’s customers are, what those customers say they like about the competitor, and the key benefits the competitor wants to highlight.

- Features & Benefits – In this section, you’ll find the features competitors offer customers, and you might also learn what customer segments they are targeting with the features.

- Pricing & Packaging – Pay close attention to the pricing page. Are there different pricing plans? Which seems to be the most popular or featured?

When you look at competitor websites, it can be tempting to just cruise through and not go deep at all. Instead, just get some first impressions, and then move on.

That would be a mistake. Instead, make sure to pay close attention to the language and document what you learn. Even if no one else will see what you write down about your competitors, you should still document it.

At FYI, we review competitor websites and pay very close attention to the language used. Plus, we watch how that language and the websites themselves change over time, too.

Early on, we saw that document apps were focused on collaboration and teamwork. Meanwhile, the newer document apps that have grown increasingly popular instead focus on all-in-one offerings and they do more than traditional document apps can.

Competitor Reviews

Before you talk to a single customer, you can learn a lot about your target customers just by looking at competitor reviews.

A few of the review sites you can use for this method of analysis include:

- G2

- TrustRadius

- Capterra

- Software Advice

- GetApp

- Founderkit

- Appbot

If your competitors have apps, you can also look at the app stores, including the Slack app store, Microsoft app store, and Chrome web store. And of course the Android and Apple app stores.

Review sites will let you gain a deep understanding of what customers like and dislike about competitors. You’ll be able to find patterns in reviews about particular features and things that customers think are missing.

But the key is to go deep. Don’t simply peruse review sites. Read all the reviews, categorize them, and analyze the results.

At FYI, we create spreadsheets with reviews and categorize them all. That helps us understand the biggest trends (top challenges, favorite features, what’s missing) for each competitor, and across them all.

Customer Switching

People switch products constantly. Especially today, when there is so much competition and so many options.

That’s why doing focused interviews about exactly why a customer switched from one competitive product to another can teach you a tremendous amount about your customers.

We’re currently in the midst of these Switch Method interviews ourselves. We did our recruiting of interviewees through cold outreach, plus with a tweet from my co-founder.

The @usefyi team and I researching why people switch document apps.

We’ve got people switching to @NotionHQ covered now.

Have you switched document apps recently to @airtable @coda_hq @gsuite @Office365 @tettra @Confluence or others?

Reply or DM me!

— Hiten Shah (@hnshah) September 9, 2019

You can also find interviewees by asking existing customers, churned customers, or using your network. The good news is that each interview only takes about 20-30 minutes, which means you won’t be burdening customers with overly-long conversations.

Our interviews are focused on people who are switching document apps, like Notion, Coda, Airtable, G Suite, Office 365, Tettra, and Confluence.

One thing we learned really quickly was that everyone who responded to our request wanted to talk about Notion, the hottest document app in town based on the amount of customer noise about it. Switching to Notion is the hot thing to do right now. Because of that, we had to do additional interviewee recruiting to cover the other apps.

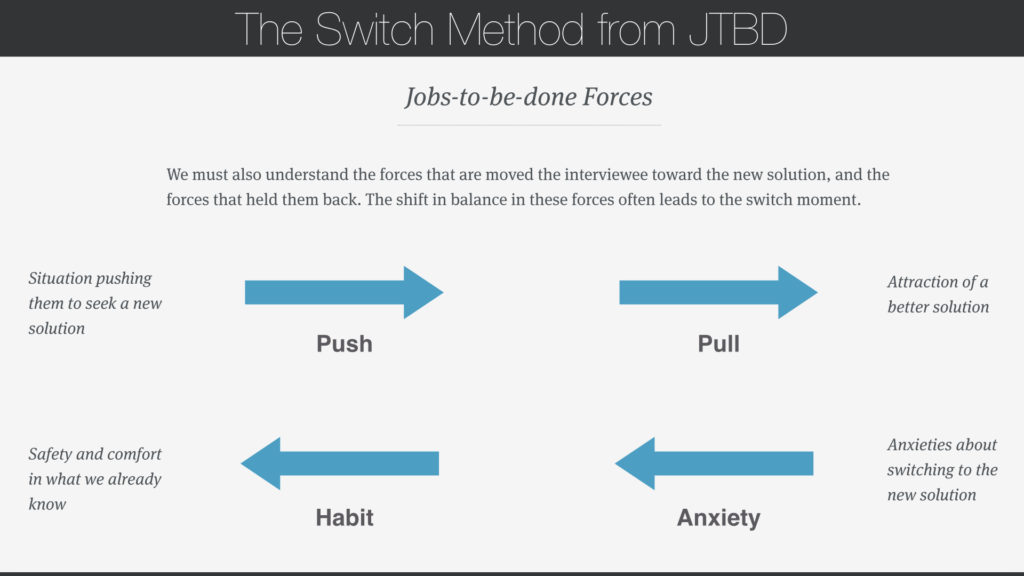

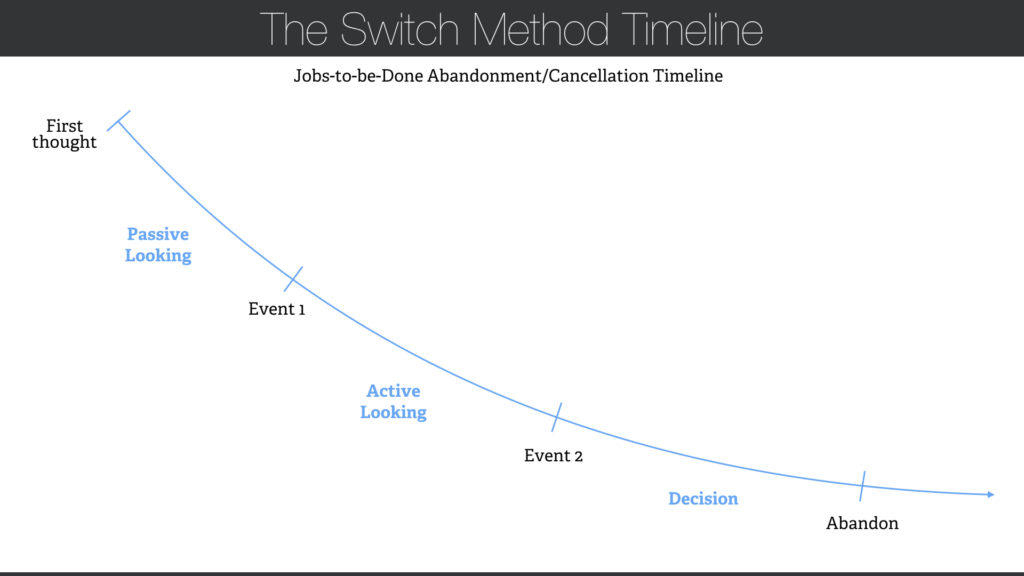

So what are Switch Method interviews anyway? It’s a framework that was created as part of Jobs-to-be-Done.

Interviews done using the Switch Method framework help you learn why people switch from one product and start to use another product instead.

The key is to create a timeline for each person who you interview. The timeline will include the exact events that lead up to someone switching over to another product. And your job is to look for patterns in those events across the people you interview.

If you decide to do switch method interviews for your product, there are plenty of detailed guides you can read that go through exactly how to do these types of interviews, like this one.

Build a Minimum Viable Product (MVP)

Ok, ok, I know I said there were 4 methods… but actually there’s a bonus way to learn about your competitors.

You build something simple to learn about your customers and competitors.

At FYI, we knew that there was a graveyard full of direct competitor apps. Plus, lots of apps that had been phased out or folded into larger companies after being acquired.

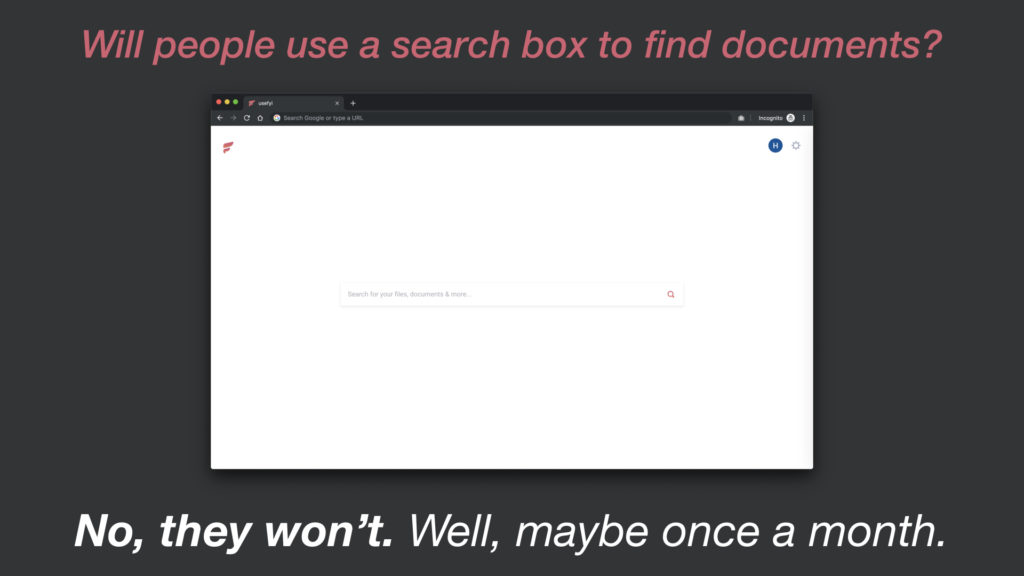

The solution those apps created for the problem of finding documents across apps and accounts was to build a search box. We knew that based on the competitive research we had conducted before we got to this step.

We wanted to test out what competitors had all done in the past. To really learn how customers feel about search as the primary solution to the problem. And also, to learn more about our indirect competitors – the apps we integrated with.

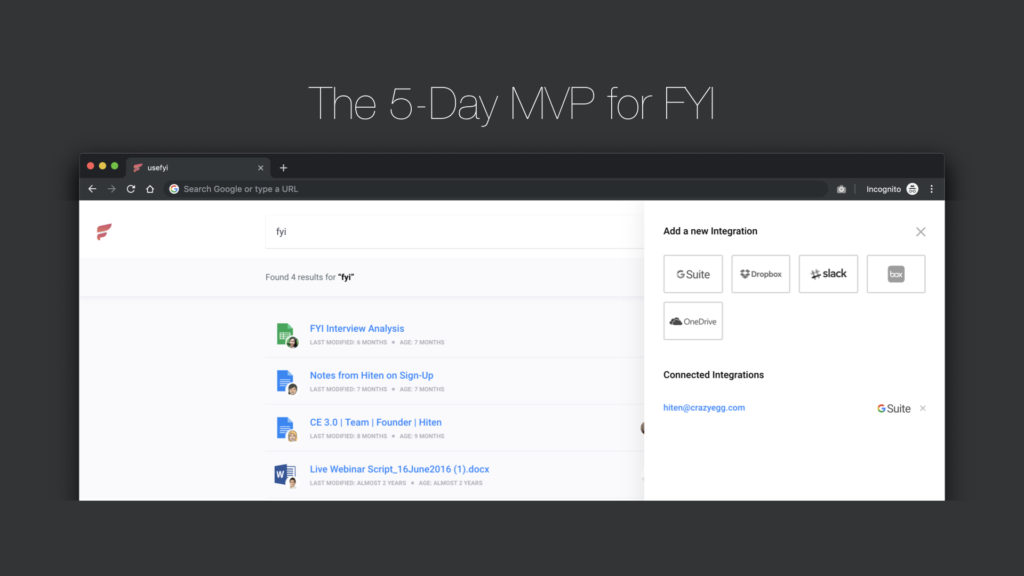

So we built an MVP in 5 days.

It wasn’t pretty. It wasn’t scalable. But it was functional. You could authenticate 5 different apps – G Suite, Dropbox, Slack, Box and OneDrive, and then search for documents across those apps.

And we built the whole thing in order to learn about our customers.

We then enlisted about 20 people to use the MVP and talk to us each week for a month. What we learned was priceless.

Our hypothesis that search wasn’t enough was spot on.

Daily retention didn’t exist. People were using the product a few times a week, some only once a month. We were also able to see once again that G Suite and Dropbox were the most popular apps amongst our customers.

This one move saved us years of mistakes.

And it’s something you can do to learn about your competitors and customers too.

If we never did competitor research at FYI, we would know much less about our customers than we do today.

We’d have no idea that customer sentiment for the document apps is so low.

We might not have realized for months, even a year, that search alone wasn’t the answer when it comes to helping people find their documents. And we wouldn’t understand how our customer’s expectations continue to change and evolve over time.

Sign up for FYI for free to see for yourself how you can find your documents in 3 clicks or less.